ASMI to sell stake in Hong Kong-listed arm

ASM International fell up to 16 per cent after saying it plans to sell a stake in Hong Kong-listed ASM Pacific Technology in an effort to increase the value of its combined businesses.

ASM International fell up to 16 per cent after saying it plans to sell a stake in Hong Kong-listed ASM Pacific Technology in an effort to increase the value of its combined businesses.

The company is selling 8 per cent to 12 per cent of ASM PT, ASMI said. The price is HK$88.88 to HK$91.77 a share, according to a term sheet obtained by Bloomberg News, which would raise a maximum of US$567 million.

"This is clearly disappointing news," said Jos Versteeg, an analyst at Theodoor Gilissen Bankiers. "People were anticipating a breakup of the company, and this is kind of a setback. I think the company decided it still needs ASM PT as a cash cow."

The sale follows a study of the market valuation of the combination, after investors pressed ASMI to separate its two businesses.

The alternatives that were investigated included a full or partial placement or sale of the company's stake in ASM, a spin-off of shares in ASM and merger options, the Netherlands-based company said.

"A partial secondary placement of 8 per cent to 12 per cent of the company's stake in ASM PT is the most suitable step to be taken to address the non-recognition by the markets of the value of the combined businesses," ASM International said yesterday.

The company intends to return about 65 per cent of the cash proceeds from the divestment to shareholders, using the remainder to strengthen the business. ASMI has no plans to further reduce its stake beyond the mentioned range, spokesman Ian Bickerton said.

"There is no part two, this is it," he said.

ASMI dropped as much as €4.94 (HK$49.91) to €26.05, the largest intraday decline since 2008. The stock was down 11.8 per cent at €27.32 in Amsterdam, giving the company a market value of €1.72 billion. Shares of ASM closed 2.1 per cent lower at HK$96.60 yesterday.

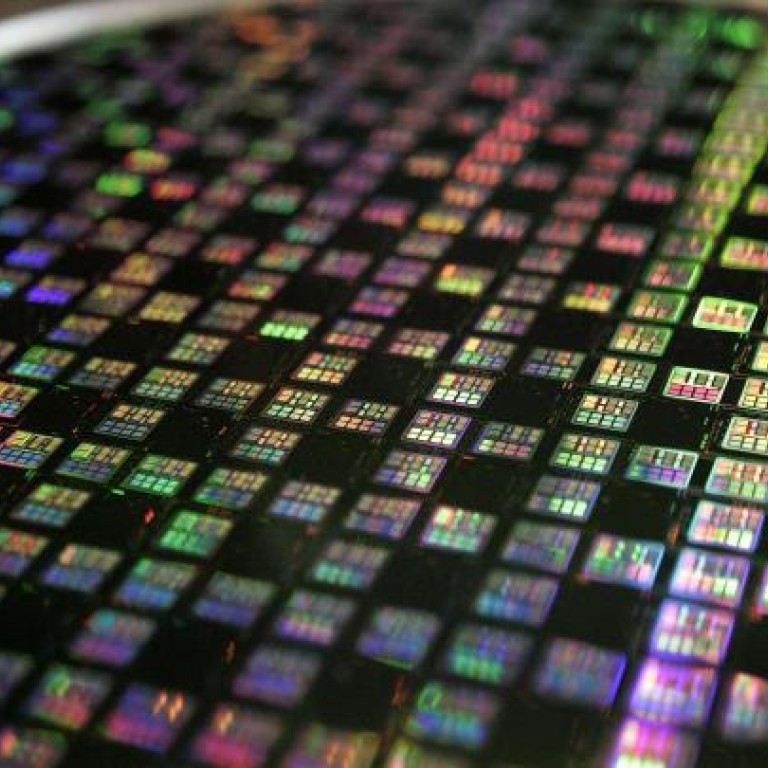

ASMI consists of two separate businesses: The front-end division makes machines used to turn silicon wafers into chips. The company also owns 52 per cent of ASM, the world's biggest maker of chip assembly and packaging equipment, known as back-end gear. After the share sale, ASMI will hold 40 per cent to 44 per cent in ASM, a term sheet shows.

With the ASMI market value lower than the value of its stake in ASM, investors have asked the company several times to break up. In May 2010, the company won backing to postpone discussion on its structure, giving it two more years to restore profitability at the front-end operations.

At a shareholders meeting in May last year a lawyer for ASMI's founder and largest shareholder, Arthur del Prado, declared that he might be open to splitting the company in two. The shares have risen 10.7 per cent since then, until yesterday.