Hong Kong IPO values surge in May on SOE listings

Outlook uncertain despite flotations in the market climbing 38 per cent year on year to US$4.6 billion in the first five months

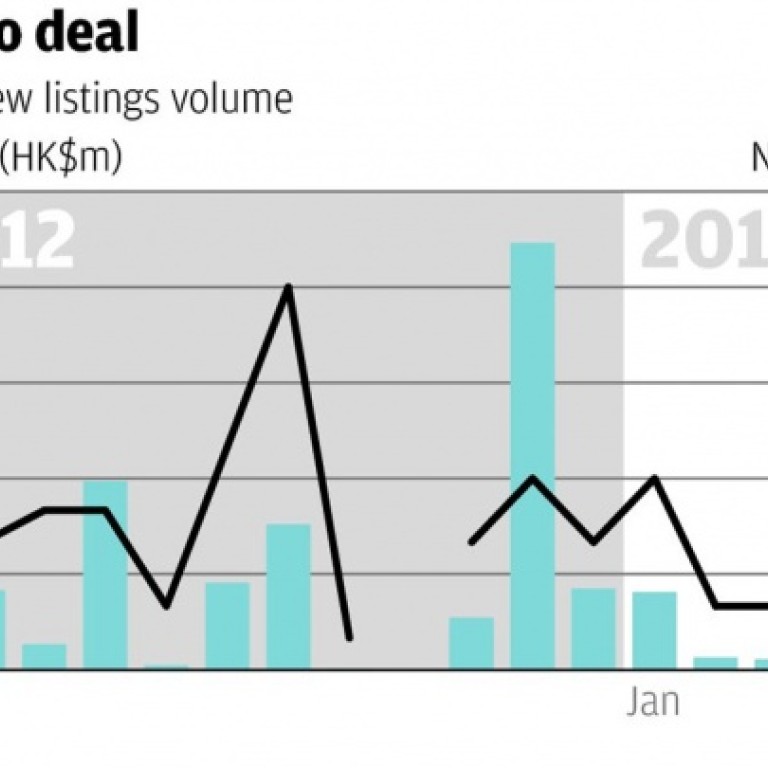

A marked improvement in the health of Hong Kong's listing market last month saw deal volumes post a big rise, mainly due to the float of two state-owned enterprises which raised almost US$3 billion.

The total value of new listings in the local market surged 38 per cent year on year to hit US$4.6 billion in the first five months.

In Singapore, deal values increased sevenfold to US$3 billion after Asian Pay Television Trust, a Singapore business trust focusing on media assets and the second-largest IPO this year, raised US$1.1 billion with the sale of the assets of Taiwan's biggest cable-TV operator, Taiwan Broadband Communications, which it was acquiring from two Macquarie funds.

The mainland listing market has remained virtually shut since October as its securities regulator undertakes a series of measures to tackle fraud in initial public offerings.

The crackdown is being led by Xiao Gang, who took over as the chairman of the China Securities Regulatory Commission in March. He has pledged to improve investor protection and enforce regulations.

Capital raisings in the secondary market on the mainland including in rights issues - whereby investors may buy a certain number of new shares for each existing one they own - remained vibrant, growing 13 per cent in the first five months to US$23.4 billion, according to data provider Dealogic.

Despite Goldman Sachs' US$1.1 billion ICBC share sale in May, secondary market offerings in Hong Kong fell 12 per cent in the first five months compared with last year, probably because issuers shifted to raising capital in debt markets amid strong demand for yield-paying instruments such as high-yield bonds and amortising loans.

The sale of Goldman's last stake in ICBC, the world's largest lender by assets, yielded the US investment bank a profit of more than US$7 billion on the seven-year investment.

The outlook for IPOs in Hong Kong remains uncertain. Investor concern about the US Federal Reserve's possible tapering off of its bond-buying programme earlier than expected, together with Japan's gigantic quantitative easing programme, has created turbulence in bond and stock markets, prompting further volatility and profit-taking.

In addition, a backlog of companies waiting to go public on the mainland has created ample supply for deal-hungry investment bankers, but investor demand for new shares remains tepid, with many staying on the sidelines because of a lack of clear direction from new policymakers in Beijing.

The disappointing debuts of Sinopec Engineering and Langham Hospitality, the hotel-focused business trust spun off from Great Eagle Investments, have also hit sentiment.

"Apart from its share-paying management fee structure, the Langham Trust offered an implied yield of 6 per cent, but its debt level could easily eat up 2 per cent of returns, leading to fewer investors as the return on safe-haven US treasuries increased," said a Hong Kong-based hedge fund manager with US$1 billion in assets under management.