Fortunes being made faster in Hong Kong

Most of city's rich individuals made their money in just 20 years, a new survey shows

Almost two-thirds of wealthy Hongkongers have accumulated their wealth in 20 years and three out of 10 have seen a fivefold jump in wealth in their lifetime, a survey has found.

Rickie Chan, the Hong Kong market head at the wealth and investment management division of Barclays, which conducted the survey, said people in general are accumulating wealth much faster as economic cycles have become shorter.

The bank surveyed more than 2,000 high-net-worth individuals with more than US$1.5 million in total net worth across 17 countries in the first half of the year.

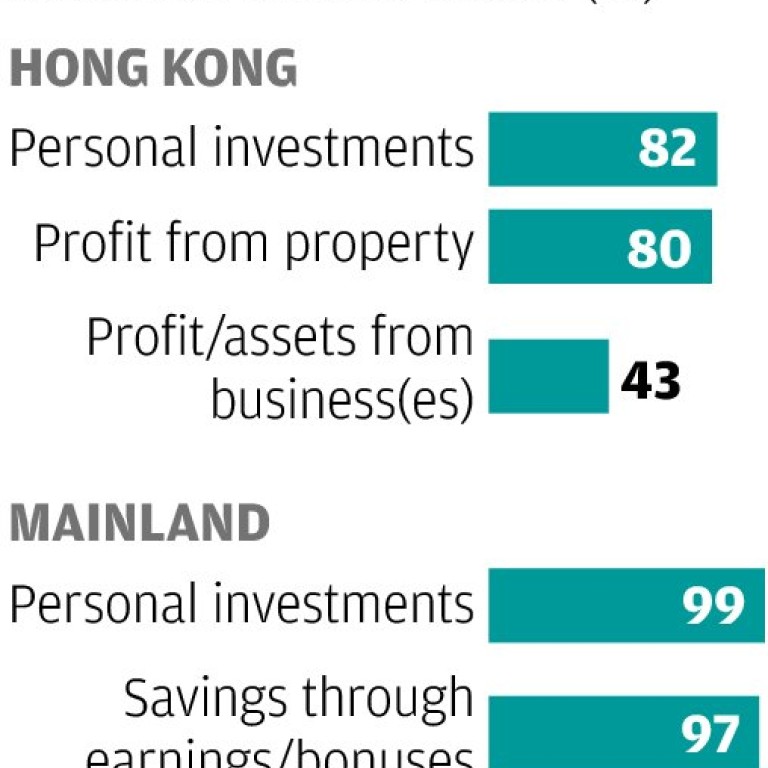

The survey found the main sources of wealth for most are personal investments and profits from property. Most such individuals on the mainland said they made their fortunes through investments and savings.

Asians, however, experienced slower growth in personal wealth than in the West. On average, 22 per cent of the rich in Asia-Pacific saw their wealth increase fivefold in their lifetime. A higher ratio was seen in the developed markets. In the US and Britain, for example, more than 60 per cent of high-net-worth individuals saw their wealth jump fivefold.

"Asian investors are usually momentum-driven. They cash the assets when the market goes down, and buy when it goes up," Chan said, adding there are more bottom fishers in the developed markets, where investors are more sophisticated and have more experience. "They like to take more risks. Some in the US invested in equity during the financial tsunami in 2008 and the returns were enormous."

"The risk appetite of investors is picking up but with a much lower leverage compared with 2007-2008," Chan said, adding high-net-worth individuals are switching from bonds to assets such as cash and equities.

Chan said people are keener to invest more in US stocks, on a geographical basis, and that some of the blue chips in Hong Kong are oversold and worth buying in phases.

The survey found many high-net-worth individuals prefer to give their money to family, friends and charity rather than leave it as inheritance.

In Hong Kong, 14 per cent of interviewees said they will pass their wealth to others while alive, compared with 8 per cent who said they would prefer to leave it in the form of inheritance.