Opinion | After belated securities reform, Hong Kong should look at insurance regulation

Twenty-five years after it was proposed, the Hong Kong stock exchange is finally going to implement a key reform that will bring it in line with late-20th century practice.

In a city known for its efficiency, that is amazingly tardy. But better late than never.

After many rounds of consultation, the government will seek in the second quarter lawmakers’ approval to change the law to allow investors to hold their shareholdings in the form of electronic records instead of paper certificates.

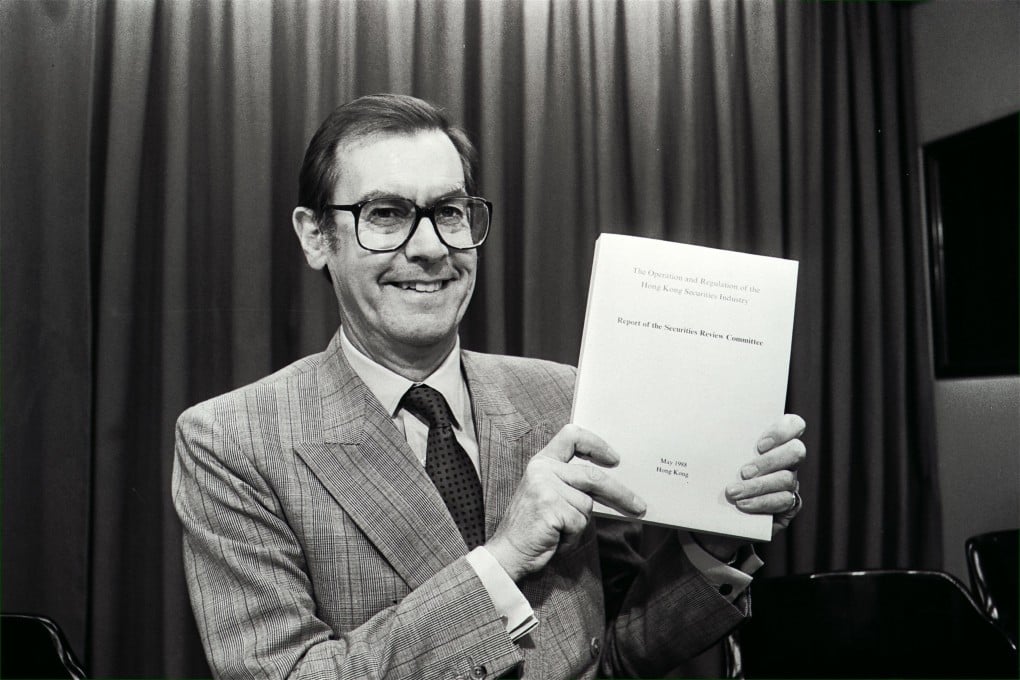

Thus will the final major proposal in the Ian Hay Davison report in 1988 be adopted. The report, which followed the 1987 market crash, was the blueprint for Hong Kong’s regulatory system today. It led to the setting up of the Securities and Futures Commission in 1989 and the introduction of a consolidated securities law – the Securities and Futures Ordinance – in 2003.

With the imminent implementation of the report’s final recommendation, it is time to think about what is the next step forward.

On the securities side, no major changes are needed, but major reforms are required to the regulatory regime for insurance.

While the SFC has been in operation for almost 25 years, the insurance regulatory system hasn’t changed.