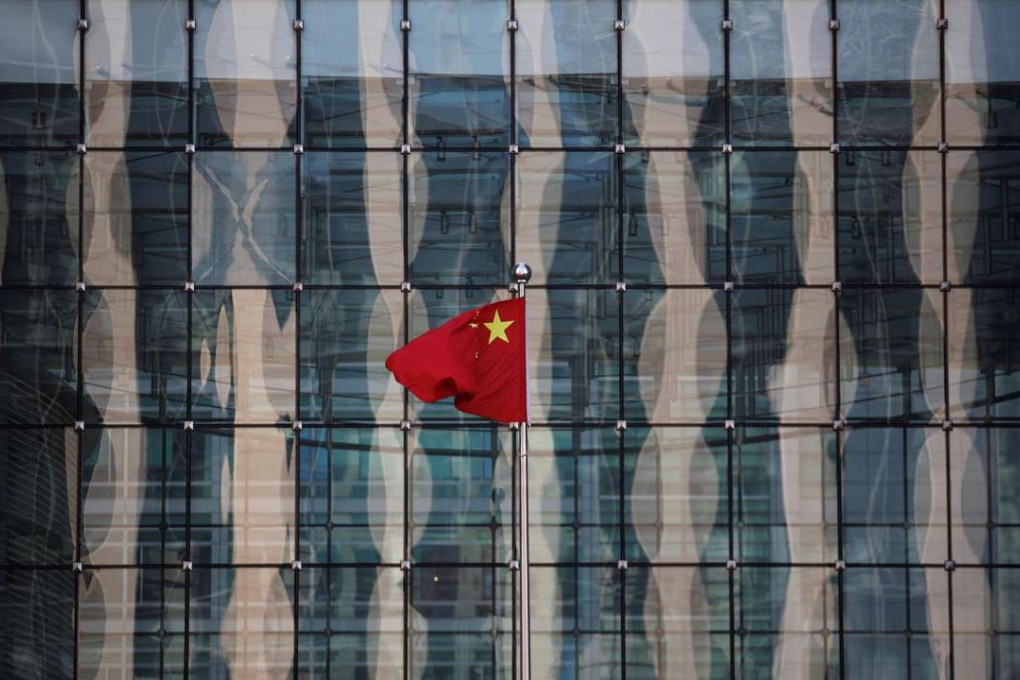

Across The Border | Bourses respond positively to Chinese banks’ improved bad debt figures

Doubts still remain about the sustainability of the progress in the longer term

The rapid rise in the share prices of big mainland banks listed in Hong Kong demonstrates the importance markets place on the lenders publically announced bad debt levels. These saw a marked improvement in the second quarter, even though the banks’ overall performance figures were mixed.

However, despite these less than stellar figures, since August 29, share prices of Bank of China and Agricultural Bank of China have risen by over 9 per cent, BoCom by 8.3 per cent and CCB by 6.3 per cent.

According to Douglas Morton, head of Asia research at Northern Trust Securities, one significant reason for this recent rise is the improved levels of bad debts that the banks announced as part of their results.

Mainland bank stocks have low price to book ratios and are offering dividend yields of about 6 per cent, which are attractive given the low yield environment elsewhere

“Global markets have become very sensitive about debt levels after the financial crisis,” he said.