MPF hits record high returns due to stock market rallies

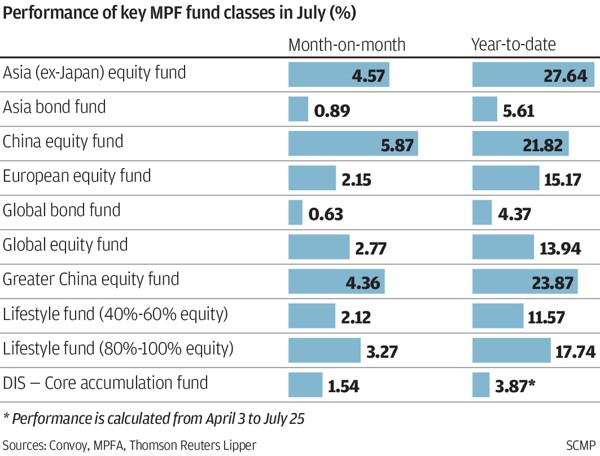

All sectors represented recorded a profit. Best performer the Asia (Ex-Japan) Equity Fund with a 27.6pc increase, followed by the Hong Kong Equities Fund (24.9pc) and China Equity Fund (21.82pc)

The average employee in Hong Kong added HK$23,677 in value to their Mandatory Provident Fund (MPF) as it reached a record high value on Thursday, according to an index complied by financial firm Convoy.

Its MPF Composite Index reached 220.54, the highest reading since the launch of the gauge, while it increased 2.8 per cent month-on-month in July and 15 per cent in the first seven months this year.

The index tracks the 100 largest MPF funds, and represents 80 per cent of its assets.

All sectors represented in the MPF funds recorded a profit, with the best performer the Asia (Ex-Japan) Equity Fund with a 27.6 per cent increase year to date, followed by the Hong Kong Equities Fund at 24.9 per cent, and China Equity Fund at 21.82 per cent.

The Hang Seng Index rose to a two-year high on Thursday, meaning the benchmark index has roared ahead 23.3 per cent this year.

Globally, US, European and many Asian stock markets have also performed strongly this year, on the back of an improved global economy.

Within the MPF, bond funds were up 0.63 per cent month-on-month in July and rose 4.25 per cent in the year to date.

The newly launched Default Investment Strategy Fund, introduced in April for members who do not choose how to invest, adopting a simple investment strategy and achieved a lower return of 1.5 per cent in July as a result, and 3.9 per cent since its launch.

The worst performer was the Conservative Fund which rose just 0.02 per cent. That invests in bank deposits, currently stuck at historic low interest rates.

RMB bond funds also only saw a 0.57 per cent return, and were among the worst performers.

“The strong performance of the MPF benefited from stock market rallies in Asia, Europe and emerging markets,” said Kenrick Chung Kin-keung, director of MPF business development at Convoy Financial Services.

Chung believes after a strong rally in the first seven months of the year, the market may slow in future and warned investors to beware of uncertainties ahead.

“Some geopolitical risks cannot be ignored, such as US president Donald Trump’s governance, the implementation of the commitments made during his campaign, especially on tax reform and trillions worth of infrastructure projects that will have a significant impact on the US economy,” he said.

The Stock Connect [schemes] led many mainlanders to invest in Hong Kong stocks in the first half and that trend will continue, as the local market is still trading cheaper than other Asian or mainland markets

“Additionally, the Sino-Indian border issue and Brexit will cause fluctuations in markets and focusing on the US Federal Reserve’s monetary policy, volatility will increase as a result,” he said.

For employees who can afford to take on higher risk options, he suggested they choose the Asia (Ex-Japan) Equity Fund or European Equity Fund.

For those who want to invest more on low-risk assets, they could opt for guarantee funds, Chung said.

The compulsory pension scheme covers Hong Kong’s 2.8 million employees and self-employed workers, and has 429 investment funds that hold stocks, bonds and currencies, according to employees’ choices.

Benny Mau, the chairman of the Hong Kong Stockbrokers Association, believes the ongoing Hong Kong stock market rally may continue into the second half.

“The Stock Connect [schemes] led many mainlanders to invest in Hong Kong stocks in the first half and that trend will continue, as the local market is still trading cheaper than other Asian or the mainland markets,” Mau said.

He reminded MPF members to “adopt a diversified investment approach in their investments, in different asset classes to diversify risk”.

“They should not bet on short-term gains from market rallies but take a longer term view as they can only take their MPF returns when they retire.”