The Insider | HSBC repurchases boost buyback value on Hong Kong exchange

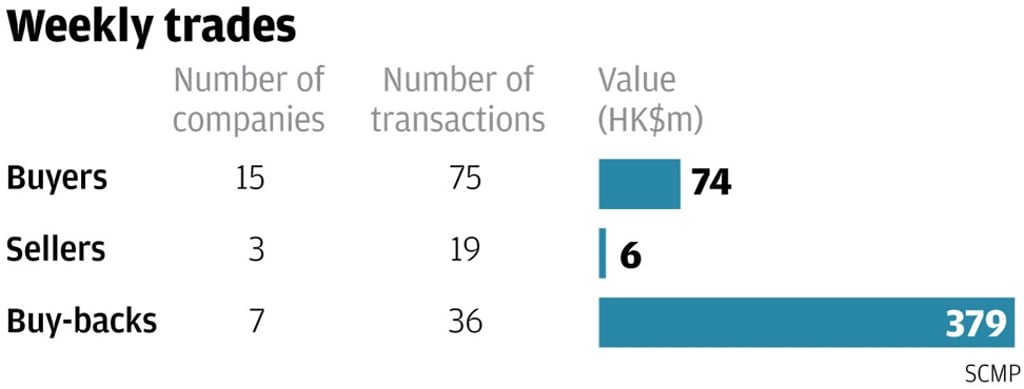

The insider activity fell for the second straight week based on filings on the Hong Kong stock exchange from July 31 to August 4, with 15 companies that recorded 75 purchases worth HK$74 million versus three firms with 19 disposals worth HK$6 million.

The figures were down from the previous week’s 23 companies, 158 purchases and HK$119 million on the buying side and 8 firms, 45 disposals and HK$55 million on the selling side.

Meanwhile, the buyback activity fell for the fourth straight week with seven companies that posted 36 repurchases worth HK$379 million based on filings from July 28 to August 3. The number of firms and trades were down from the previous 5-days’ totals of 14 companies and 46 repurchases.

The value, however, was nearly triple the previous 5-days’ turnover of HK$133 million. The huge buyback value was due to repurchases by blue chip HSBC Holdings last week worth HK$319 million.

Despite the slowdown in director and buyback activity, there were several significant filings last week with buybacks in HSBC Holdings and rare insider buys in Carrianna Group Holdings, Vestate Group Holdings and developer Central China Real Estate Limited.