UK’s ‘juggernaut’ student-housing market attracts Asian capital as persistent shortage promises lasting low-risk returns

- Q Investment Partners, GIC among those investing in the sector

- A recent CBRE report showed a shortage of more than 350,000 student beds across 30 major university towns in the UK

Asian investors are chasing opportunities in the UK’s market for student accommodation as burgeoning university populations perpetuate a shortage of such housing, promising low-risk returns for the foreseeable future.

Capital from Asia accounts for some of the biggest recent investments in the UK student accommodation market, led by Singapore and Malaysia.

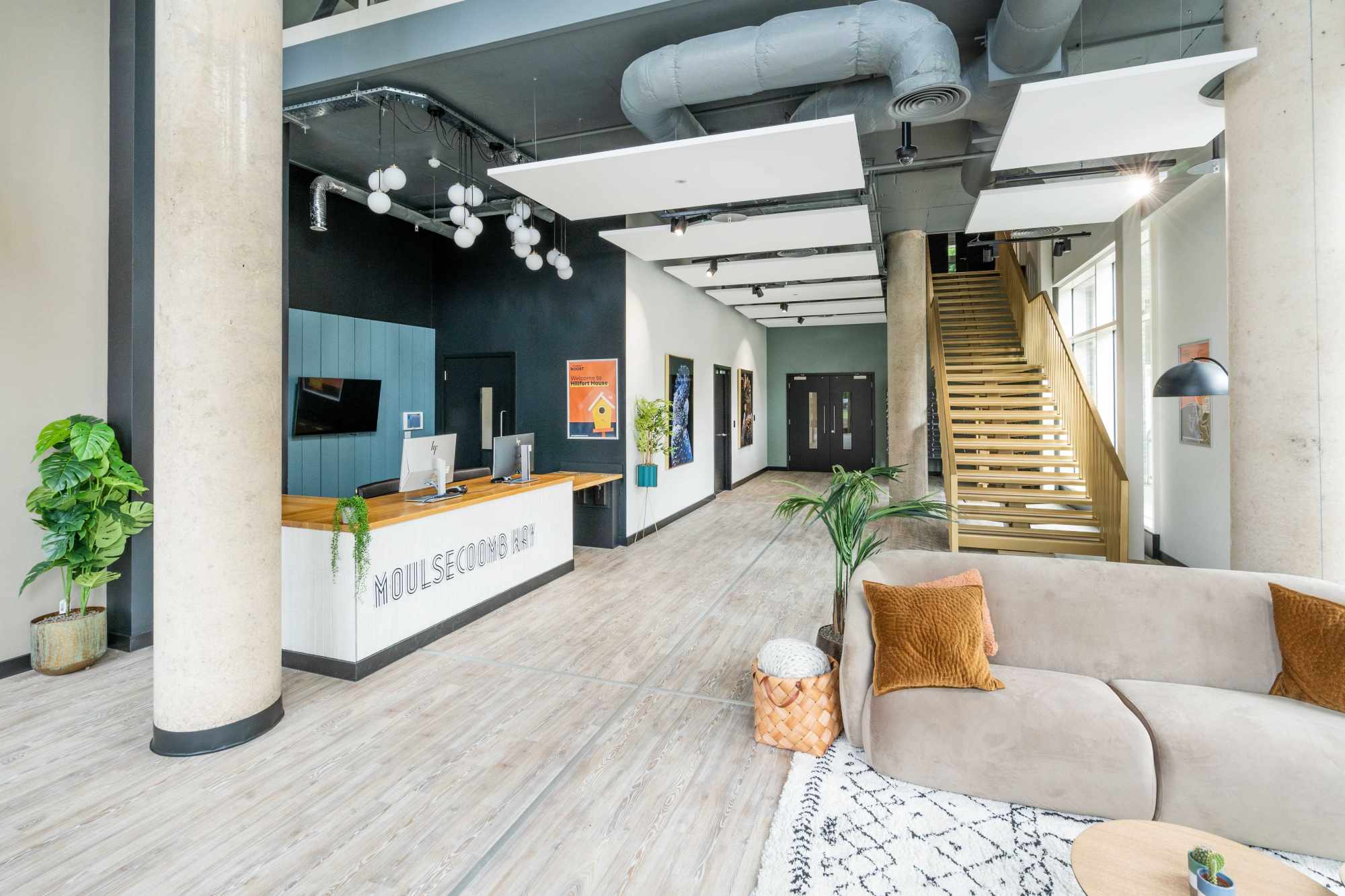

Q Investment Partners (QIP), a Singapore-based private equity firm, along with Singapore-based developer Soilbuild, formed a £200 million (US$253 million) investment platform to develop UK student housing in March.

Asian investors are “taking centre stage” in shaping the future of the market, said Peter Young, the CEO of QIP. “As these investors seek opportunities that offer both solid returns and stability, UK PBSA [purpose-built student accommodation] has emerged as a stand-out choice.”

QIP’s UK portfolio includes eight student-accommodation assets with around 1,700 beds in total, with 1,000 operational and the rest in development. Demand is “robust” and the company expects full occupancy for the start of the coming academic year.

“Looking ahead, our aim is to gradually acquire a £700 million asset portfolio by the close of 2024,” said Young.

Other Asian investors, including Singapore-based GIC and City Developments, as well as Malaysia-based Sunway RE Capital, have also bought into the student-property business in the last two years. For example, GIC in May 2022 partnered with Greystar Real Estate Partners to buy Student Roost, then the UK’s third-largest provider of PBSA with more than 23,000 beds.

The UK is home to more than 200 colleges and universities, and enrolment by both domestic and international students is expected to increase far faster than growth in student accommodation in the coming years.

“For the next 10 years or so, we will have an increasing number of 18-year-olds in the UK and an increasing proportion of those wanting to go to university,” said Tim Pankhurst, head of student-accommodation valuation at CBRE. “With a sort of juggernaut coming down the road, we’re going to see pretty phenomenal student growth over the next five to 10 years.”

‘I want to open my eyes’: more Chinese students join rat race to study abroad

A recent CBRE report showed a shortage of more than 350,000 student beds across 30 major university towns in the UK. The supply gap has deepened 45 per cent in the London area compared with five years ago, reaching 106,000 beds, according to CBRE.

“The shortage is across the market, including all sorts of university beds and privately held beds,” said Oli Buckland, head of PBSA transactions at CBRE.

The need is acute not only in London. In Bristol, just 2,900 beds have been delivered since 2018, but the need for student accommodation has grown by 8,000 beds in that time frame. In Glasgow, 3,400 beds have been built since 2018, but the need has expanded by more than 13,000.

The shortfall in PBSA looks set to persist because of supply-side factors as well, according to experts.

“It seems clear that we will see unending student housing shortages for the next decade at least,” said Kashif Ansari, the CEO and co-founder of real estate company Juwai IQI. “The shortages are made more acute by the simultaneous shortage of affordable homes in most UK urban centres on the private rental market.”

UK universities should welcome Chinese students, not seek to close the door

According to CBRE, the total number of House in Multiple Occupation licences – required for any residence where members of more than one household share common areas – decreased by 4 per cent from 2019 to 2021, which is equivalent to removing 60,000 to 80,000 beds from the rental market.

In addition, many universities in the UK have been focusing on upgrading their academic buildings rather than building housing in recent years, leaving the private sector to fill the bed gap, said CBRE’s Buckland.

However, due to increasing costs and supply-chain disruptions during the pandemic, progress is slow. The cost to build student accommodation has more than doubled in 10 years, reaching £80,000 to £90,000 per bed, Pankhurst said. This leads providers to set pricing at around £160 per week, which is higher than the rent level in more than 70 per cent of the towns in the UK, he added.

Students from China are a major factor driving the demand for PBSA. Among 680,000 international students studying in the UK during the 2021-2022 academic year, more than 150,000 were from China. The number of first-year Chinese students declined 4 per cent through the pandemic period, but Chinese students have made up the largest international student segment among first-year students in the UK for more than a decade.

India is the second biggest source of international students; the population of incoming first-year students from the country grew almost fivefold in the 2021-2022 academic year compared with three years earlier.

“Since 2019, the UK has made visa policies which are much more favourable towards the students, so that they can stay and work,” said Saurabh Goel, the CEO and co-founder of Amber, an India-based booking platform for student accommodation, which serves students from more than 50 countries.

“We’ve seen increasing accommodation needs from Chinese students who plan to study in the UK, especially this year as China reopened its border,” said Charlene Fan, marketing manager of UniAcco CN, another booking platform.

Both companies said the demand for living quarters is much higher than the supply. So much so that many students eagerly pay deposits as early as possible – even before they have received acceptance from a school or obtained a visa.

“Most mainland Chinese buyers are purchasing for their student children, so they have a place to live while studying without being dependent on a fickle rental market,” said Ansari.

The recent 5 per cent decline in the yuan does not seem to be deterring Chinese buyers, as they are “making up lost time” after three years of closed borders, Ansari said.