Beijing advisers propose tax on large stock sales to narrow the wealth gap

The top advisory body to the country's legislature has recommended taxing gains from "large" sales of equities held for short periods to help narrow the nation's wealth gap, Xinhua reported.

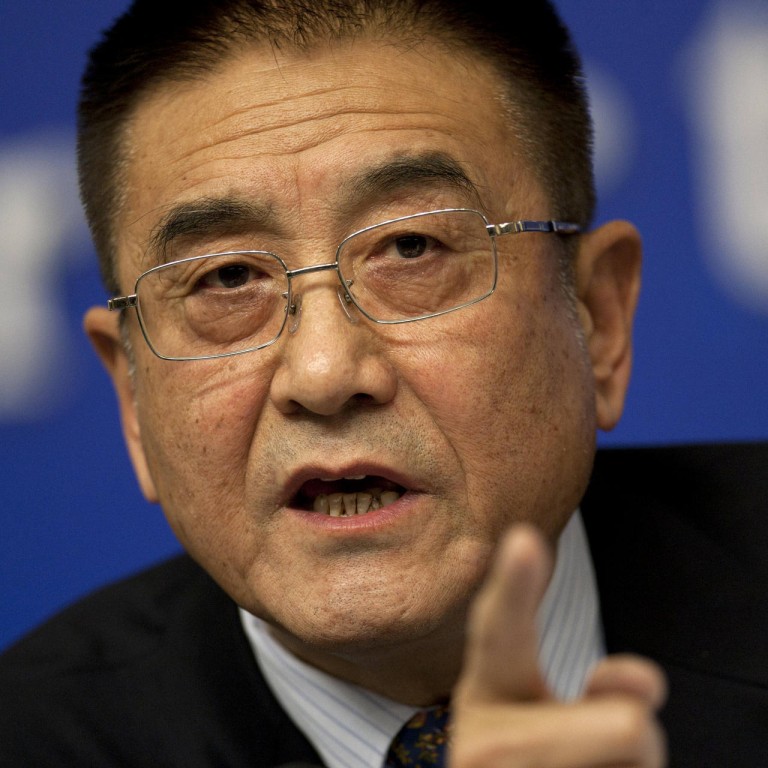

The economic committee of the Chinese People's Political Consultative Conference also suggested reducing the stamp tax for trading of stocks that had been held for long periods and reducing taxes on dividends, the news agency reported late yesterday, citing comments by Liu Kegu, a member of the CPPCC committee.

The central government does not now tax gains from stock trading.

Premier Wen Jiabao has listed the need to narrow the divide between the rich and poor among the country's priorities amid concern the growing wealth gap could spark social unrest.

The central government has sought to achieve that by raising the threshold for paying income tax, building subsidised housing and banning officials from using public funds to buy luxury goods.

Past policies on income distribution ignored problems of "justice and balance", Xinhua cited Liu as saying on behalf of the economic committee during a CPPCC meeting.

The report did not define what might be considered a large stock sale.

Liu also suggested increasing the amount of profits that state-owned companies were required to pay to the central government and making it easier for private capital to be invested in all industries, Xinhua reported.