Analysis | Private equity professionals are cautiously optimistic

Private equity investment will remain strong in 2017 as global investors continue to expand into different markets.

Returns may not be as impressive as they were in 2015 and 2016, because general partners (GPs) and limited partners (LPs) are tempering their strategies due to concerns about the impact of increasing regulation, high asset values, and the need to keep their powder dry.

Investors are the most bullish (“very positive”) about private equity performance in the rest of the world (62 per cent) and Asia (57 per cent), compared to North America (54 per cent) and Europe (50 per cent)

During the second half of 2015 and the first half of last year, private equity funds performed above expectation, according to 97 per cent of GPs and 95 per cent of the LPs in Mourant Ozannes’ survey of 260 respondents around the world.

The survey covered 50 GPs (each with a fund exceeding US$200 million) and 20 LPs in each of Asia, North America, Europe, and the rest of the world. Their work spanned private equity, venture capital, and real estate funds.

Of the Asian professionals surveyed, 45 were in China, eight in Hong Kong, and three in Taiwan, comprising in total 80 per cent of Asian respondents.

Looking into 2017, positive sentiment dropped to 88 per cent. Investors are the most bullish (”very positive”) about private equity performance in the rest of the world (62 per cent) and Asia (57 per cent), compared to North America (54 per cent) and Europe (50 per cent).

Apparently, optimism about Asia reflects on fund raising, at least as it relates to China. PricewaterhouseCoopers recently reported that private equity and venture capital funds raised in the Chinese market increased 49 per cent in 2016 to US$73 billion.

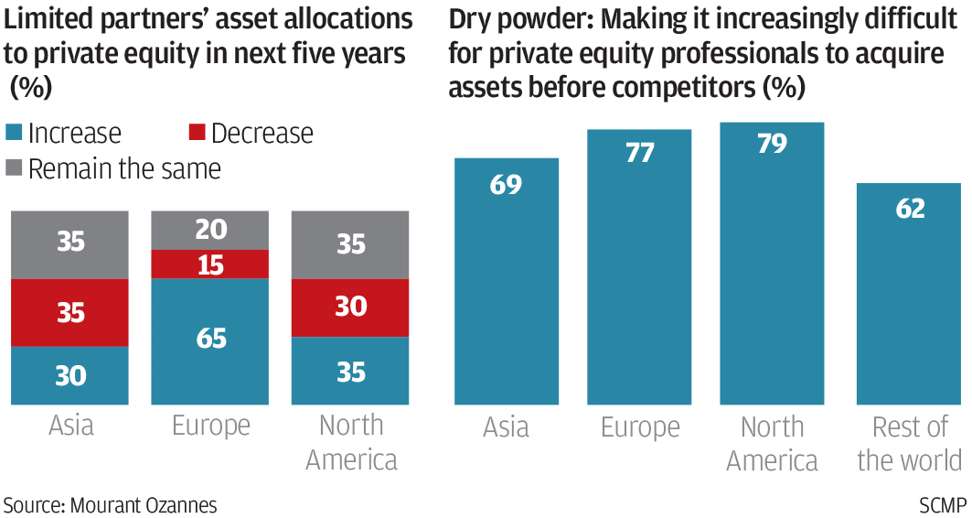

By 2021, 43 per cent of the LPs surveyed, plan to increase their capital allocation to private equity.

Nearly two-thirds of them (65 per cent) will increase investments in Europe, followed by North America (35 per cent) and Asia (30 per cent).

The rationale for increases and decreases in allocation are varied. Some investors express concern about investment risks, although many of them claim to have a higher risk appetite in North America (47 per cent), Europe (44 per cent), and Asia (43 per cent) and a marginally lower risk appetite for the rest of the world (38 per cent).

Thirty-five per cent [of limited partners] intend to reduce their investments in Asia, compared with North America (30 per cent) and Europe (15 per cent)

In the next five years, according to 66 per cent of GPs and 58 per cent of LPs, there will be a significant increase in private equity investment in advanced emerging countries, as defined by the Financial Times Stock Exchange (FTSE) country classification.

Real estate private equity funds exceeded expectations in the second half of 2015 and the first half of 2016, according to 95 per cent of the all respondents involved in real estate funds – approximately the same number, (93 per cent), remain bullish for the first half of 2017.

Both GPs and LPs expect 2017 to be another strong year. However, their expectations are tempered by a few concerns, not least of which is regulation.

Increasing regulation is one of the biggest challenges to the growth of private equity.

Over the past few years, regulation continued to increase so it’s not surprising that slightly more than half (52 per cent) of investors expect the trend to continue for the next five years globally.

Only 37 per cent of private equity professionals in Asia foresee increasing regulation, compared with 66 per cent in North America, 52 per cent in the rest of the world, and 51 per cent in Europe.

The biggest concern about increasing regulation is expected to be its chilling effect on investment as a result of investing becoming more difficult and restrictive geographically. Asian GPs find it more challenging to raise funds from EU investors since the introduction of the Alternative Investment Fund Managers Directive (AIFMD).

Another concern is dry powder, or unallocated but committed capital.

Almost three-quarters (72 per cent) of survey respondents said the rising level of dry powder is making it increasingly difficult to acquire assets before their competitors, as a result of pricing competition.

High asset values are affecting relationships between GPs and LPs. Just over half (54 per cent) of GPs and nearly two-thirds (63 per cent) of LPs believe that high asset values are straining their relationships with each other. Both groups said LPs want to invest capital more quickly than GPs because they are worried about missed opportunities.

Perhaps that’s why 56 per cent of GPs and 63 per cent of LPs said they expect direct PE investing to become a more popular option for institutional investors over the next five years.

Direct investing will be more popular in Europe (63 per cent), Asia (60 per cent), and North America (57 per cent) versus the rest of the world (46 per cent), the survey showed.

Whether or not the direct investments succeed depends on the skills and knowledge necessary to be successful, according to some of the GPs we interviewed.

In short, the general outlook among private equity professionals can be described as cautiously optimistic. Whilst the industry would be well served to ensure it is understood in order for future regulation to be kept at appropriate levels, its success in raising funds will start to challenge itself in terms of valuations, with direct and co-investment opportunities continuing to frame a potential new dynamic.

Paul Christopher is the managing partner of the Hong Kong office of Mourant Ozannes. He leads the corporate and investment funds team in Asia and has a specialist focus on private equity