Hang Seng adds private firms to raise H-share index’s appeal as benchmark for China investors

The Hang Seng China Enterprises Index, the benchmark that’s been tracking the performance of Chinese companies on the Hong Kong bourse since 1994, will get a major makeover, adding 10 additional private enterprises to double its coverage to half of the capitalisation of all Chinese companies traded in the city.

Starting from March 2018, 10 so-called red chips and P chips will be added to the index in five phases lasting over a year, increasing the total number of members of the gauge to 50.

“The additional companies will increase the representation and the appropriateness of HSCEI to investors tracking Chinese corporates,” said Vincent Kwan, director and general manager of Hang Seng Indexes, the wholly owned Hang Seng Bank unit that compiles and maintains the index.

The makeover is a measure of how much Hong Kong’s role as a financial centre, and the composition of the city’s capital market, have changed over the past two decades since sovereignty was returned to mainland China from Britain.

The addition of P chips, those private enterprises registered in offshore havens, but with mainland China operations and traded on the Hong Kong bourse, expands the diversity and increases the investible options for global investors.

Already, global funds with US$7.7 billion of assets under management track the performance of their China investments using the HSCEI, compared with US$19 billion using the city’s main yardstick the Hang Seng Index.

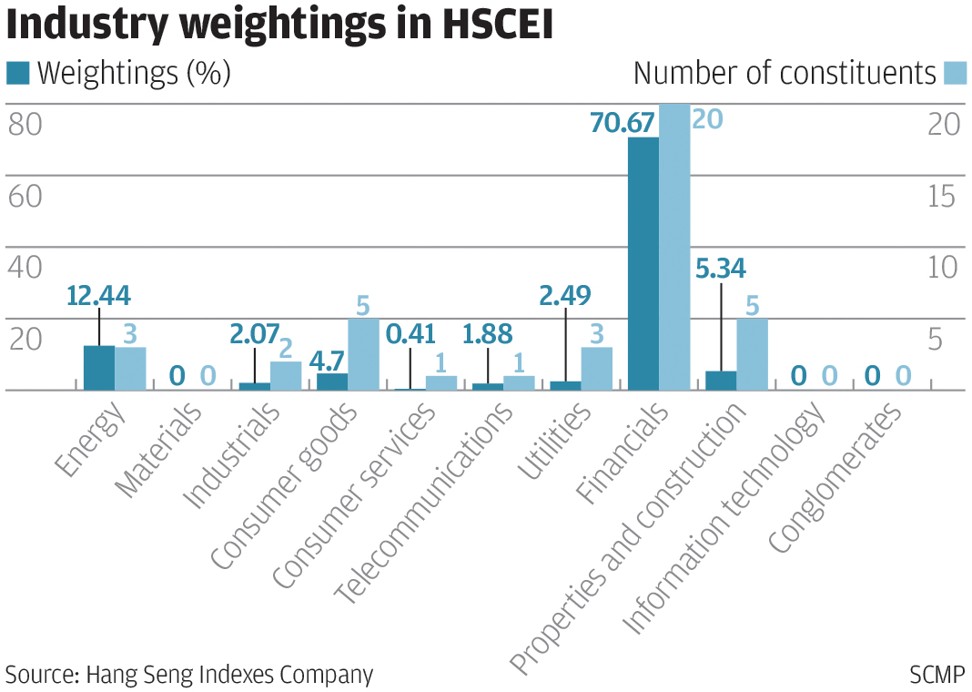

The reconstitution will likely shift the weighting of the index members, with financials falling to 51 per cent from the current 70 per cent, while commerce and industry rise to 41 per cent from 21 per cent. The market capitalisation of the HSCEI of all listed Chinese companies will increase to 56 per cent from the current 26 per cent.

As at the end of 2016, H-shares accounted for only around one-third of the total market capitalisation of Chinese enterprises listed in Hong Kong. They are also dominated by mainland Chinese banks, insurers, and oil and gas companies.

“The state-owned enterprises sector is generally held back by elevated debt, overcapacity issues and low returns, while the private sector (accounting for approximately 70 per cent of the Chinese economy) show signs of recovery,” Caroline Yu Maurer, Head of Greater China Equities at BNP Paribas Asset Management said before Hang Seng’s announcement. “Therefore, not having (or partially having) the private sector in the Hang Seng index, while private sector represents the bulk of the economy, does not seem to make Hang Seng index the most representative index of China.”

The HSCEI has a competitor in the form of MSCI China Index, which captures Chinese large and mid-cap stocks across H-shares, B-shares, Red Chips, P-chips, and foreign listings.

“We believe that MSCI China index better reflects the Chinese equities universe, given the diversity of asset classes available in the index,” Yu Maurer said.