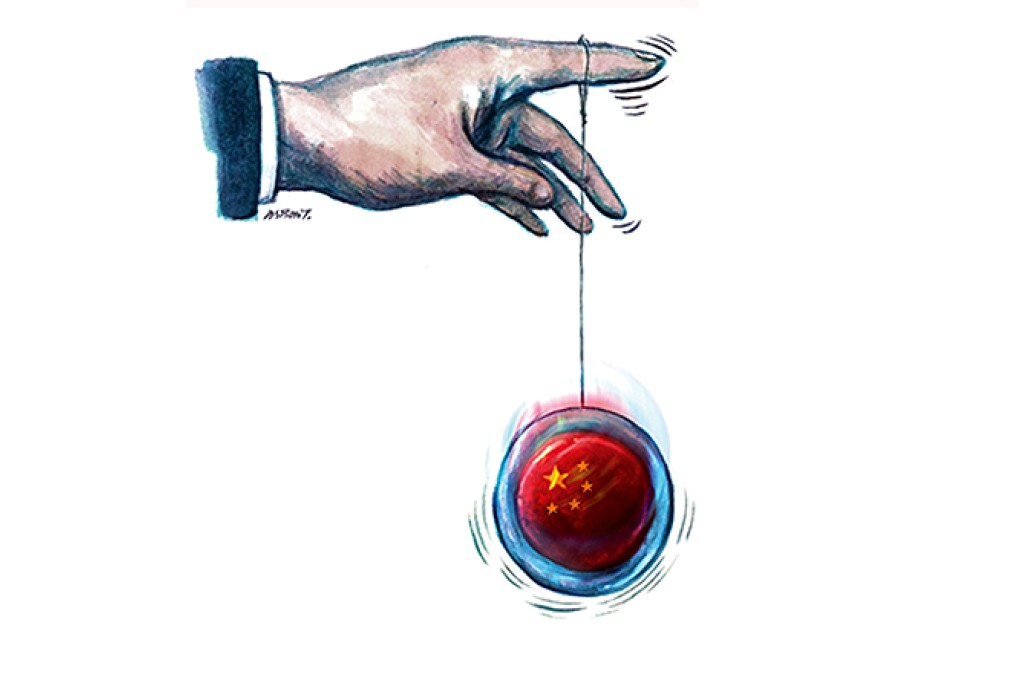

Rumours of a Chinese crash are greatly exaggerated

Yu Yongding says predictions of a Chinese economic crash fail to allow for Beijing's room to manoeuvre, first in neutralising the catalysts for collapse, then in limiting the damage even if it happened

The market is always in search of a story and investors, it seems, think they have found a new one this year in China. The country's growth slowdown and mounting financial risks have spurred a growing wave of pessimism, with economists worldwide warning of an impending crash.

But dire predictions for China have abounded for the past 30 years, and not one has materialised. Are today's really so different?

The short answer is no. Like the predictions of the past, today's warnings are based on historical precedents and universal indicators against which China, with its unique economic features, simply cannot be judged accurately.

The bottom line is that the complexity and distinctiveness of China's economy mean that assessing its current state and performance requires a detail-oriented analysis that accounts for as many off- setting factors as possible. Predictions are largely pointless, given that the assumptions underpinning them will invariably change.

Consider China's high leverage ratio, which many argue will be a key factor in causing a crisis. After all, they contend, developing countries that have experienced a large-scale credit boom have all ended up facing a credit crisis and a hard economic landing.

But several factors must be accounted for in assessing whether this is China's fate. While China's debt-GDP ratio is very high, the same is true in many successful East Asian economies, such as Taiwan, Singapore, South Korea, Thailand and Malaysia. And China's saving rate is much higher. Ceteris paribus, the higher the saving rate, the less likely it is that a high debt-GDP ratio will trigger a financial crisis.

In fact, China's high debt-GDP ratio is, to a large extent, a result of its simultaneously high saving and investment rates. And, while the inability to repay loans can contribute to a high debt burden, the nonperforming-loan ratio for China's major banks stands at less than 1 per cent.