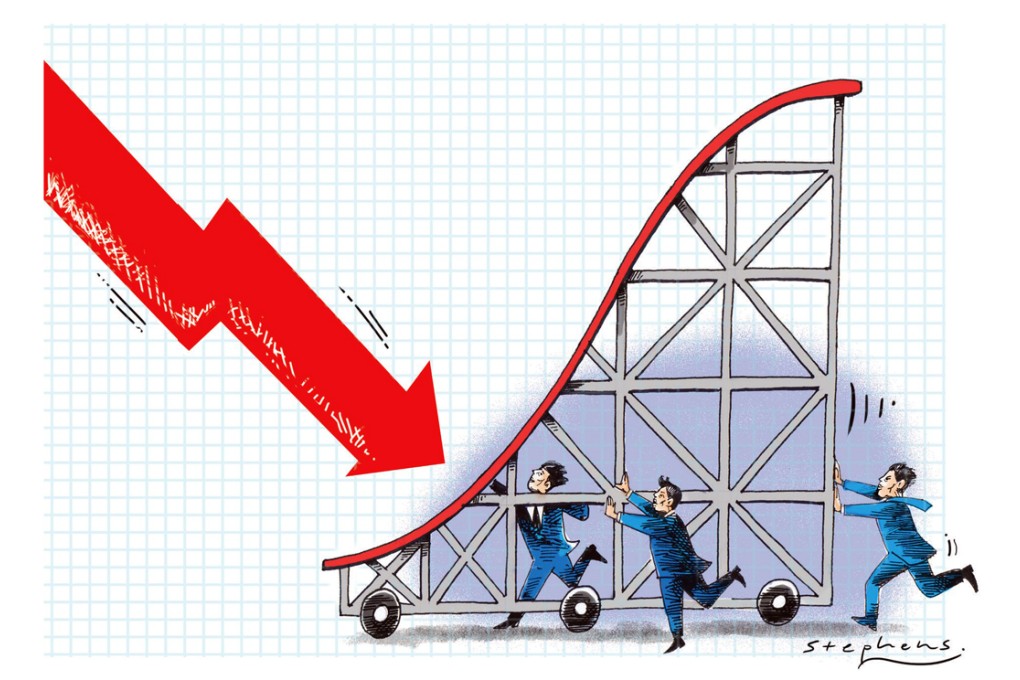

Reform, not monetary stimulus, is China's only choice to revive growth

Andy Xie says to revive growth, China must step up market reforms to tap its inherent competitiveness, while shutting out calls from vested interests for more monetary stimulus

China's economy continues on a downward trend. The main reason is the lack of significant reforms to implement the decision of the party Central Committee's third plenum. Sentiment, both at home and abroad, is at the lowest point in a quarter of a century. If reforms remain just talk, not action, the downward spiral could trigger a financial crisis.

To stabilise the economy, China must cut taxes by 1 trillion yuan (HK$1.26 trillion) or more. Value-added tax should be cut to 13 per cent, from 17 per cent, the top personal income tax rate slashed from 45 per cent to 25 per cent, and contributions to social funds halved for three years.

The central government should issue fiscal bonds to plug the resulting shortfall. To ensure the fiscal deficit is temporary, it should cap spending by local governments and the companies under their control.

Since the last quarter of 2011, China's economy has been deflating, a consequence of irresponsible, illogical and massive monetary stimulus in response to the 2008 global financial crisis. China has wasted tens of trillions of yuan on image projects and property speculation, all in the name of preserving its gross domestic product growth rate. The resulting bad assets are now weighing down the financial system.

The periodic injection of liquidity merely allows troubled financial institutions to delay reporting bad loans. They don't have the capital or ability to finance China's economic transformation.

International experiences of coping with numerous crises since 2008 show that injections of liquidity have a limited and diminishing effect. Fiscal stimulus is a much more potent tool to stabilise a declining economy. And, most of all, only structural reforms can revive a troubled economy on a sustainable basis.