Advertisement

Jake's View | Is the Hong Kong Monetary Authority being two-faced on bank accounts?

Tough on money laundering and tough to get basic services

Reading Time:3 minutes

Why you can trust SCMP

If we discover that they are unfair to customers and in breach of the basic requirements for providing banking services, we will exercise our statutory powers to demand them [sic] to rectify their practices.

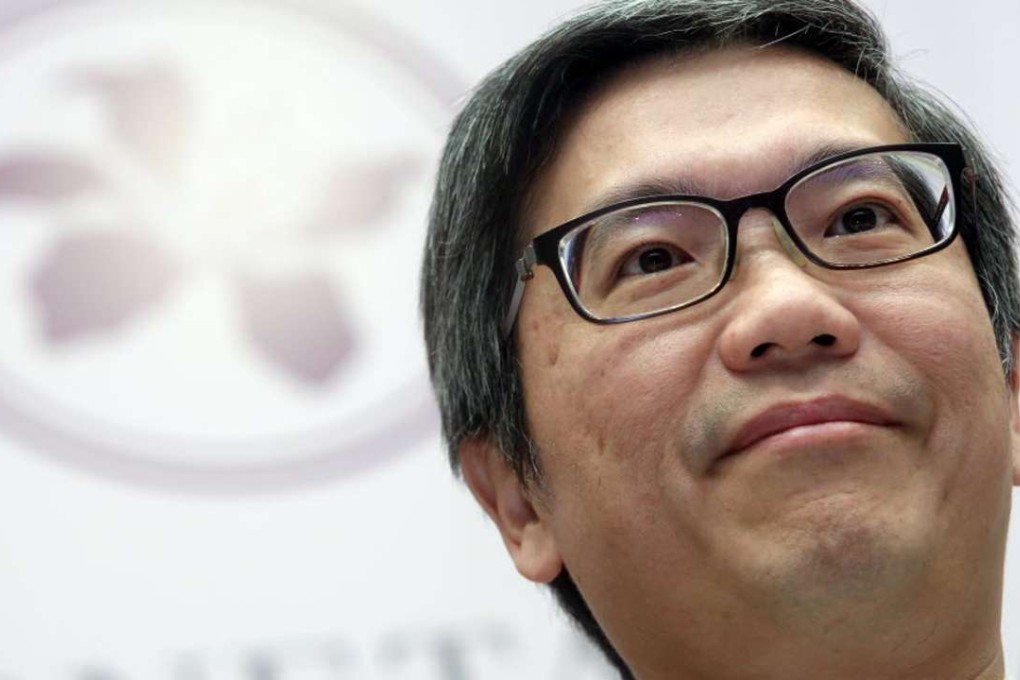

Arthur Yuen, deputy chief executive,

HK Monetary Authority,

Advertisement

SCMP, September 9

Advertisement

You can just hear that fist pounding that desk. When we told banks to get tough on money laundering, we wanted them to get tough, not tough. There is a difference, you know. Anyone can see that.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x