Wealth Blog | How spreading the wealth around helps communities and legacies

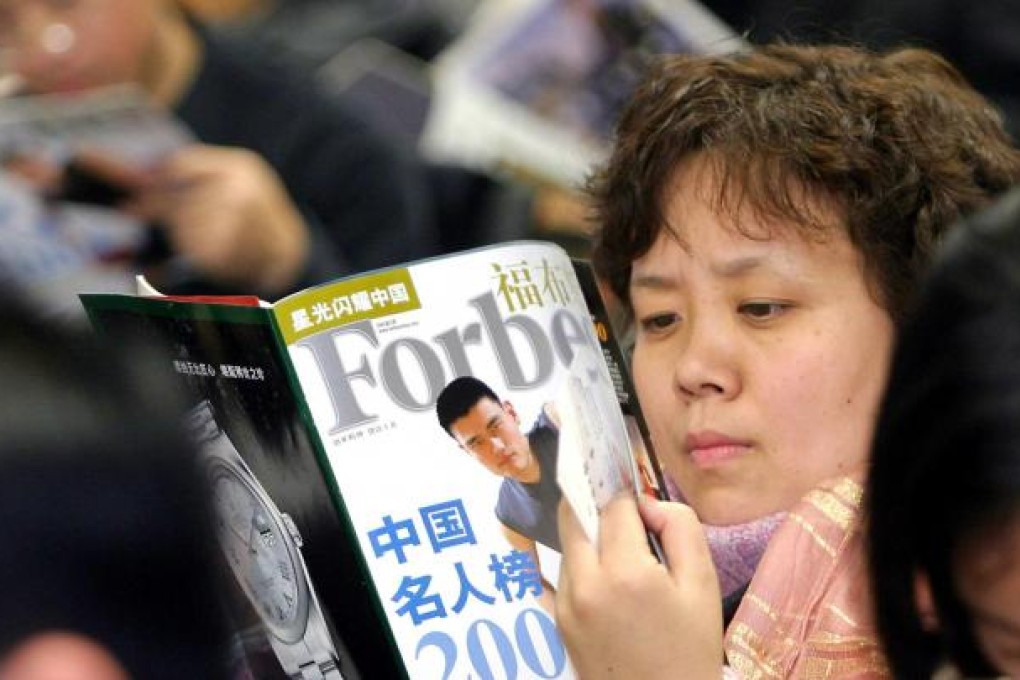

Looking at the latest Forbes rich lists for Asia it’s interesting to note that while multinationals are actively seeking young consumers to buy their products, a vast number of Asia’s richest are distinctly grey haired. Take Indonesia - half of the country’s 235 million population is under 29 and their spending power is climbing fast, Forbes says.

But the region’s billionaire set is anything but young. The average age of the 25 Indonesian tycoons on the 2013 Forbes Billionaires List is 66. Hong Kong’s richest don’t look much better. Li Ka-shing, worth US$31billion (HK$241 billion), is 84, followed by Lee Shau-kee, worth $20.3 billion (HK$158 billion) at 85. Next comes Thomas and Raymond Kwok at $20bn (HK$155 billion), no age given but neither are spring chickens, and Cheng Yu-tung at $16bn (HK$124 billion) is 87.

You get the general drift. The average age of Japan’s billionaires is 68 years, in sharp contrast with a bevy of 30 and 40-something fortunes minted in the U.S. and elsewhere; 11 out of 29 billionaires under 40 are U.S.-based. Nor is Indonesia an unusual in Southeast Asia. Malaysia’s population of super-rich is smaller with an average age for billionaires of 73.5, the highest in the region. Singapore’s s rich set is a bit younger, averaging 63.2 years. Meanwhile Thailand’s ultra-rich clock in at an average of 65 years.

It’s hardly surprising, given that it takes a good few decades to amass such a vast fortune. Not everyone rockets to the top, and those that do may not stay the course, observes Forbes. Inheritances are also a big factor - inherited wealth is still a big part of the story in Europe, as human longevity stretches ever further and inheritance waits longer. Nevertheless, serious wealth seems stuck in a bit of an ageing rut in Southeast Asia. New wealth is of course being created in China, where the first generation of capitalists is coming of age and in some cases, maturing.

And many of Southeast Asia’s tycoons made their fortunes during the boom years of the 1970s and 1980s though many got clobbered by the 1997 crash, but most recovered.

What’s interesting is the next generation, now that so much money is stuck in the hands of so many older super rich, mostly men in this category. Chief executive CY Leung can go on all he likes about rich-poor gaps, but he would do well to focus on the very people who make sure it stays that way.