Bitcoin Buzz | Bitcoin prices tumble after cyberattack halts major exchanges

A major hacking ripped through Bitcoin, crippling exchanges for several hours early on Wednesday morning, after hackers exploited a weakness in the digital currency’s core infrastructure network.

Deploying a distributed denial-of-service (DDoS) attack, a method which overwhelms websites with requests for data, companies were unable to process Bitcoin transactions.

“This went from an isolated exercise that was happening to a single exchange to a relatively broad-based attack,” said Andreas Antonopoulos, chief security officer of digital wallet provider Blockchain.

Antonopoulos, who first made the discovery, said he wasn’t sure how many were involved in the attack or where it originated from.

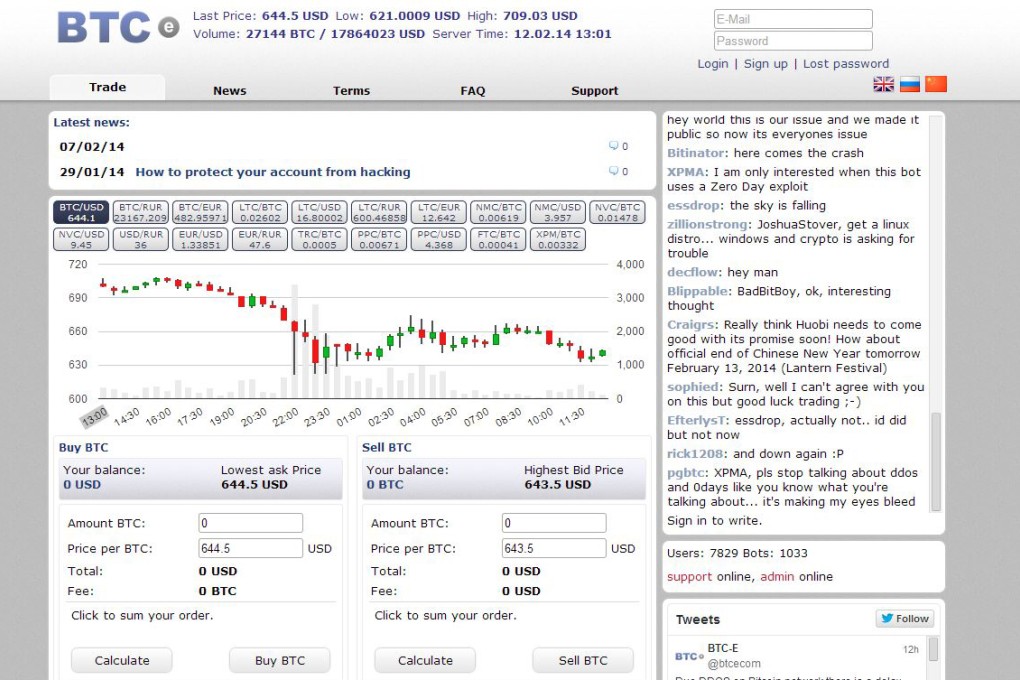

The top two exchanges – Bitstamp and BTC-e – controlling more than half of market transactions, suspended or delayed coin withdrawals, as trading platforms stepped up checks and inspections on order books.

Both company’s prices dropped more than US$100 (HK$780) to US$664.25 on the Coindesk price index following the interference discovery, extending the lowest price levels reached on both exchanges.