Advertisement

The Hongcouver | Vancouver’s housing crisis: No, not like before, and not like anywhere else (except Hong Kong)

Reading Time:4 minutes

Why you can trust SCMP

Ian Youngin Vancouver

Try discussing Vancouver’s affordability crisis with enough baby boomers and you’ll probably encounter two corrosive falsehoods.

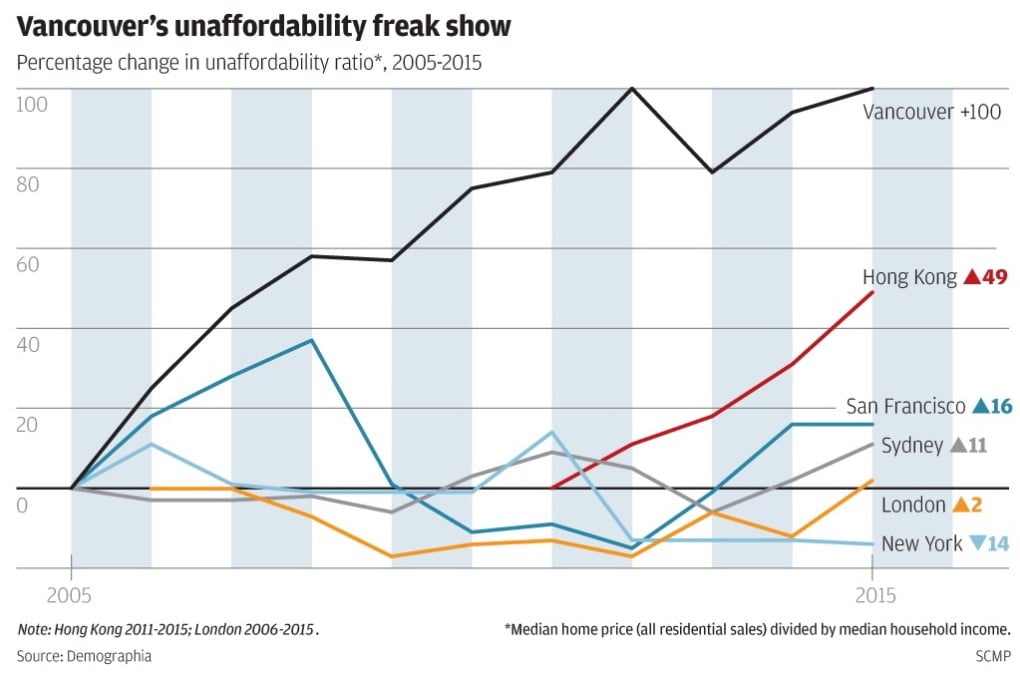

The first states that Vancouver might be unaffordable, but it’s been like this before. The second states that even if Vancouver has become particularly unaffordable recently, other “world-class” cities are being hit to the same degree everywhere, and Vancouverites should get used to it, because it’s the new normal.

For full effect, these sage observations are best delivered with a worldly sigh. Maybe a kindly pat on the head.

Advertisement

The subtext is that Vancouver’s pampered millennials should stop whining about the fact that their city’s real estate is now the second-least affordable in the world, according to Demographia’s* study of 378 cities around the globe in nine major markets. Sometimes it’s not even the subtext. Sometimes it’s the actual text.

The problem is that both positions betray a disregard for facts that is either woefully ignorant or wilfully self-serving.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x