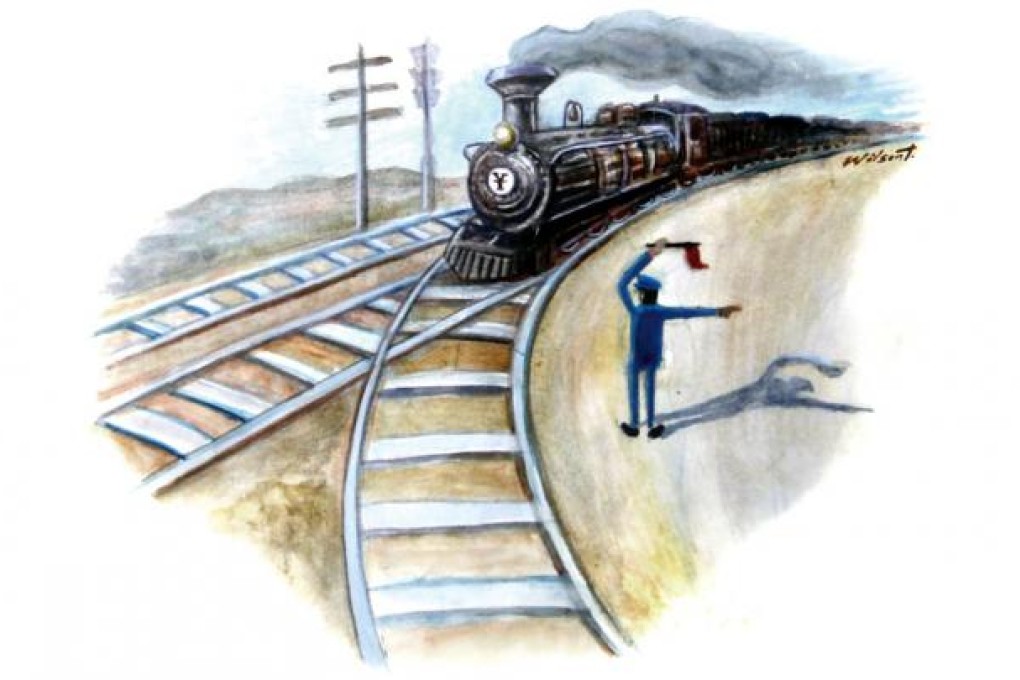

China's economy in need of a new wave of reforms to avoid contraction

Ha Jiming says China needs a repeat wave of reforms like those of the late 1990s. Targets today should include industrial inefficiency, and its outdated tax and social security policies

Vice-Premier Li Keqiang said at a recent State Council seminar that "reforms are China's greatest dividends". Indeed, a review of China's economic performance in the past two decades shows that reforms played a critical role in lifting China's growth potential. There is no doubt that low labour costs contributed to China's rapid economic expansion during the period, but this demographic dividend was not the sole engine of growth.

Rapid fiscal and monetary expansion spurred short-term growth in 1992-93, but excessive bank credit and investment led to high inflation and overcapacity in many industries, lowering the country's growth potential up to 1998. Then, in the next three years, China rolled out important structural reforms aimed at improving efficiency and identifying growth drivers.

Reforms of state-owned enterprises and privatisation from 1998 broke up vested interests and made the industrial sector more efficient. Housing reforms introduced that year unleashed tremendous pent-up demand for property and provided impetus to the economy, particularly in housing-related industries.

China's accession to the World Trade Organisation in 2001 provided a further boost to manufacturing and brought international competition that forced domestic enterprises to improve efficiency.

These reforms set the stage for economic acceleration while keeping inflation under control. The economy grew strongly for a decade. By 2007, benefits from these reforms began to dissipate as inflation picked up, but no new substantial reforms were introduced. Instead, the government launched massive fiscal and monetary stimulus in 2008-2009 to counter the impact of the global financial crisis. While this package failed to raise growth potential, it led to a short-term rebound at the cost of soaring property prices and serious overcapacity problems that impeded growth in the following years.

We expect China's growth potential to decline in the absence of fundamental reforms, given that its demographic dividend will soon become a deficit requiring greater public spending on social welfare.

China is badly in need of economic reforms like those of the late 1990s to improve economic efficiency and identify new growth drivers. Judging from Li's comments, we believe a number of policies are being contemplated.