Taxpayers swindled by sweetheart deal with mainland gas company

We'll have higher electricity bills because CLP Power was forced to buy from PetroChina

I have my misgivings about announcements made in the middle of a holiday season when no-one is looking. I have them in this case because the extra cost to consumers could amount to tens of billions of dollars relative to the deal CLP might have had.

The background is simple enough. As part of ongoing investment to meet our energy requirements and tighter environmental standards, CLP had proposed a liquefied natural gas (LNG) receiving terminal on the remote Soko Islands. There, the LNG could be restored to its gaseous state and sent by a short pipeline to power generating plants for a much cleaner fuel burn than coal.

Planning for this project and negotiations with foreign gas suppliers were already underway when the Hong Kong government intervened in 2008 and rejected all. The deal must be done with a mainland entity, it said.

Observers of these events noticed a distinct similarity to a puppet show in this rejection but one cannot really fault the mainland puppeteer. PetroChina was smacking its lips at the prospect of a hard currency customer. You would have done so, too, if you were in its shoes.

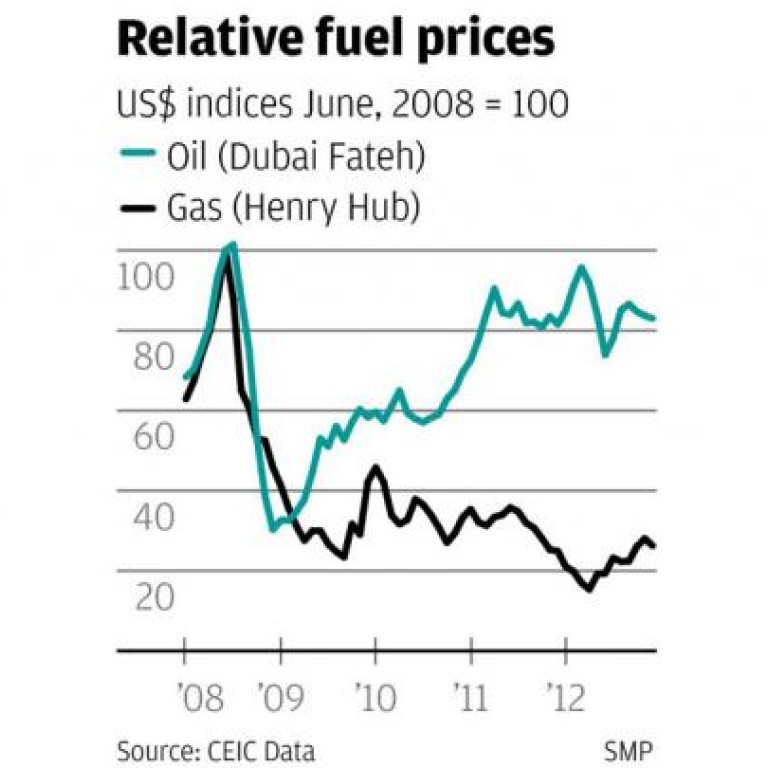

Meanwhile, fundamental changes were shaping themselves in the world of gas supply. Seemingly out of nowhere, the phenomenon of shale gas emerged and established itself so strongly as to bring about a fundamental disconnect between oil and gas prices. The chart shows you the scale of the difference since 2008.

But it was too late for CLP. The company might have been able to tap into cheap shale gas with an LNG terminal on the Sokos. Instead, it has been trapped in a long-term high-priced PetroChina contract. The whispered CLP holiday announcement revealed that pricing will be determined by the following factors:

- A commodity element, reflecting the cost of the gas imported from Central Asia to China, in which (sic) typically moves in line with the prices of oil.

There you have it from the horse's mouth, crucified to the price of oil at a time when gas prices have tumbled.

- A transportation element, reflecting the cost of pipeline transportation charged by the pipeline owners for taking the gas from the Central Asia border in Xinjiang to Hong Kong.

That pipeline is actually to come all the way from Turkmenistan. That makes it the longest pipeline in the world, and also the biggest energy investment project in China's history.

Don't expect the "pipeline owners" to be kind to CLP in their pricing. CLP is their only hard currency customer. The rest are all in the mainland and pay yuan.

I can't give you a comparable figure for the shipping costs of LNG from shale gas terminals in the United States.

But I'll stake the contents of my wallet on any odds you care to name that it would be much lower than the full accounting cost of building and operating a Turkmenistan pipeline.