China's years of spectacular growth have become so second-nature that when data fails to meet analysts' expectations, investors get worried. Figures released yesterday showed that in the first quarter, the economy grew by 7.7 per cent compared with a year earlier, below most forecasts of 8 per cent. Stock markets immediately took a tumble. But while lower gross domestic product levels are a matter of concern for some people and governments counting on Chinese trade and investment to boost their economies, rates that are manageable are what the nation most needs.

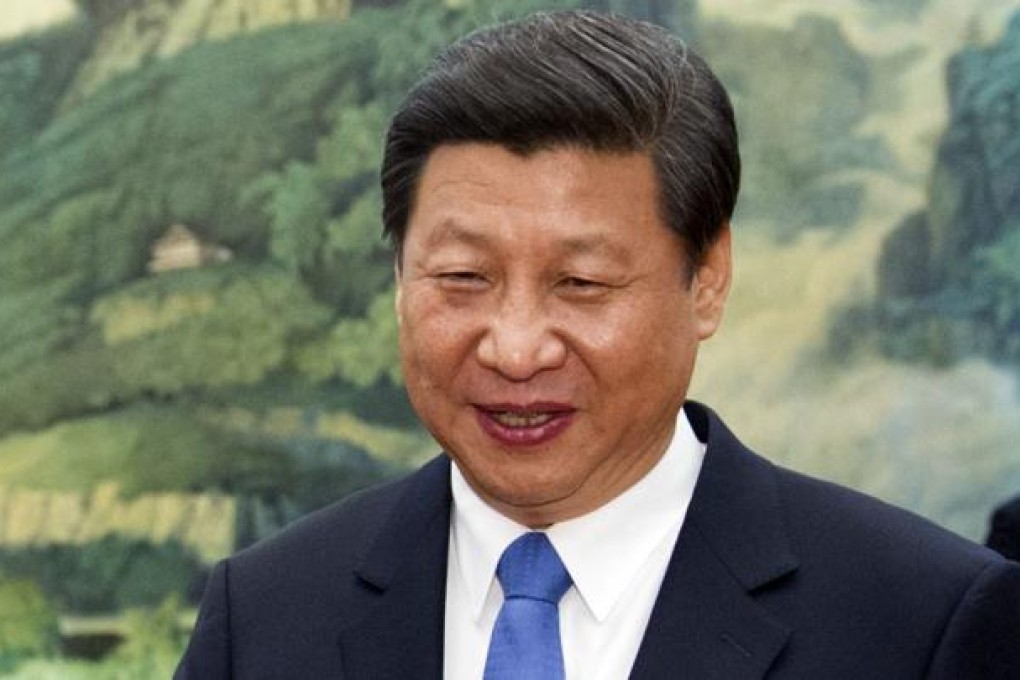

President Xi Jinping's government well knows this. The latest data was within its projected forecast of between 7.4 and 7.9 per cent, a range desirable so that vital economic reforms can be implemented. The double-digit growth rates of the past 30 years created unparalleled fast development but were not conducive to introducing systemic changes. Now that GDP growth is lower, there is a better chance of moving towards what is necessary, a sustainable consumer-orientated economy backed by major structural changes.

The previous model of export-driven trade, foreign investment and government cash injections, mostly to state-owned enterprises, could not be sustained. It produced spectacular growth but was accompanied by environmental destruction and damaging societal trends and shifts. Yet it is what foreign governments and investors want more of; they have been urging Beijing to boost money supply so that GDP growth will remain above 8 per cent. Fortunately, Xi, Premier Li Keqiang and other officials know this is not what China wants or needs, and have set a target for the year of 7.5 per cent.

At such a level, there is a better chance of keeping inflation in check and preventing an asset bubble from excessive liquidity. State bank lending and the property market are particular areas of concern. Too much money supply in the US, Europe and Japan has prompted warnings by the International Monetary Fund and others of hidden financial risks, but China faces the same danger. M2, the broadest money-supply measure, was 94.4 trillion yuan (HK$117.17 trillion) at the end of September, while GDP for the first three quarters was just 35.3 trillion yuan.

China's days of economic hyper-growth are at an end. In their place has to be a model of sustained growth centred on domestic consumption. Pressure for a rethink has to be resisted. The best future now lies in manageable growth.