BAML analysts win again in Institutional Investor survey

The anxious wait is over, and the results of Institutional Investor’s All-Asia Research Team, the magazine’s annual ranking of the region’s best sell-side analysts, reveal that Bank of America Merrill Lynch has retained its crown for the third consecutive year. The firm captured 33 positions, with 16 of its analyst teams considered the best in their sectors. Runner-up was Credit Suisse, which came seventh last year, followed by Morgan Stanley, which jumped from sixth to third, and UBS. Deutsche Bank slipped from fourth to fifth, while Citi fell from second to sixth. JP Morgan also suffered a big fall, from second to eighth.

Mining and money

In 2010, mining rock star Robert Friedland said in a keynote speech at the Mines and Money conference that “Hong Kong will become the largest mining finance market in the world”. That dream has yet to reach fruition. Meanwhile, a flyer for the Mines and Money Beijing conference later this year notes that a recent report from the National Development and Reform Commission predicts that Chinese outbound investment will grow to US$88.7 billion this year. It adds that last year 59.5 per cent of outbound investment went into natural resources. This, for the moment, makes China a magnet for mining finance.

Sweet dreams

A new survey has come up with the extraordinary finding that three in four financial professionals in Hong Kong plan to jump ship and find a new employer this year. The survey, by search firm eFinancial Careers, also claims that only two in three in Singapore and one in two in Australia are planning to switch jobs. Some 36 per cent of those surveyed in Hong Kong said they were looking for pay increases of 10 to 19 per cent, while 32 per cent of professionals wanted 20 to 29 per cent. We’re a little surprised by such optimism from a sector that still seems to be shedding jobs.

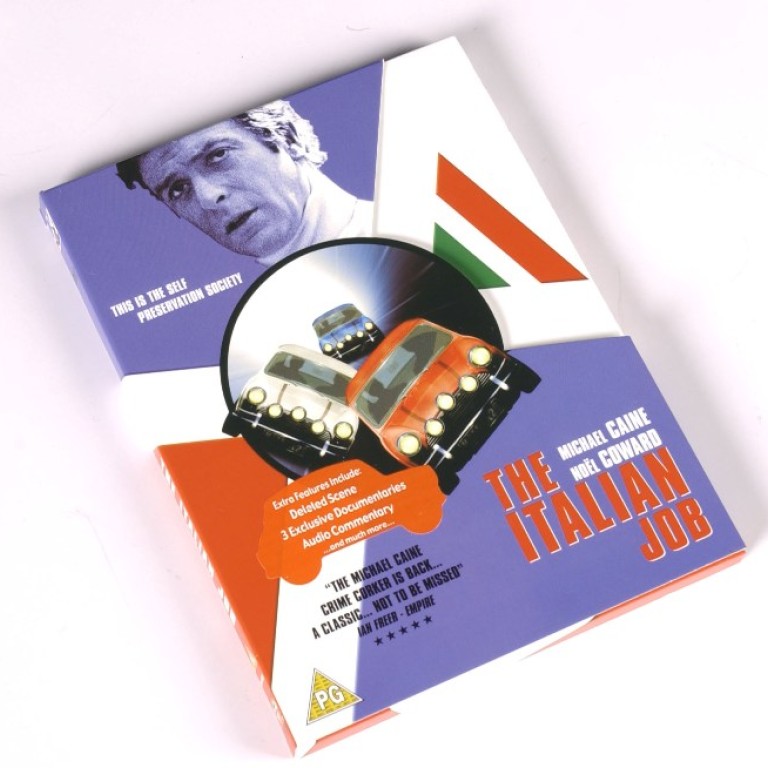

The Chinese Italian Job

Luxury car sales crash

The crackdown on conspicuous spending appears to be showing up in luxury car sales. The luxury car market has been crushed, sales growth slowing to 8.3 per cent for the first three months of the year compared with growth of 80 per cent for the comparable period last year. BMW, the world’s top selling luxury brand, sold 118,200 cars in the first four months, up17.8 per cent from a year ago, compared with year-on-year growth of 35 per cent last year, Caixin reports. Audi sales grew 13.9 per cent in the four-month period, compared with 41.4 per cent last year. Sales of luxury cars rose 80 per cent in 2010 and 41.4 per cent in 2011, when growth of overall car sales fell to as little as 4 per cent. However, despite the slump, McKinsey says the mainland, which is already the second-largest market for luxury cars after the US, with sales of 1.25 million last year, is expected to achieve sales of 2.25 million in 2016 and 3 million by 2020.