iBonds are little help in easing inflation and a bad bet financially

The game show here is that our government offers a three-year HK$10 billion bond issue, available in allotments of HK$10,000, which pays a coupon of the rate of consumer price inflation or a minimum of 1 per cent. Given that bank deposits over the past four years have carried interest rates averaging between zero and nothing while the CPI has averaged 3.2 per cent year over year and is at present higher and threatening to go higher yet, the iBond is obviously not a bad bet.

The ancient Romans had a phrase for it - - bread and circuses. To forestall unrest among the poor, give them a little food and a lot of game show.

In Hong Kong, for bread read Comprehensive Social Security Assistance (CSSA). For circuses read iBond. There are others but iBond will do.

The game show here is that our government offers a three-year HK$10 billion bond issue, available in allotments of HK$10,000, which pays a coupon of the rate of consumer price inflation or a minimum of 1 per cent. Given that bank deposits over the past four years have carried interest rates averaging between zero and nothing while the CPI has averaged 3.2 per cent year over year and is at present higher and threatening to go higher yet, the iBond is obviously not a bad bet.

But just why should our government want to offer these things when it clearly does not need the money? Our public coffers are brimming with more than HK$1.5 trillion in assets net of any non-government liabilities, topped up by steady fiscal surpluses.

In his 2011 budget speech, when he announced the first iBond tranche, financial secretary John Forgettable explained the purpose as, "The issuance of inflation-linked retail bonds, or 'iBond', will help reduce the impact of inflation on our people."

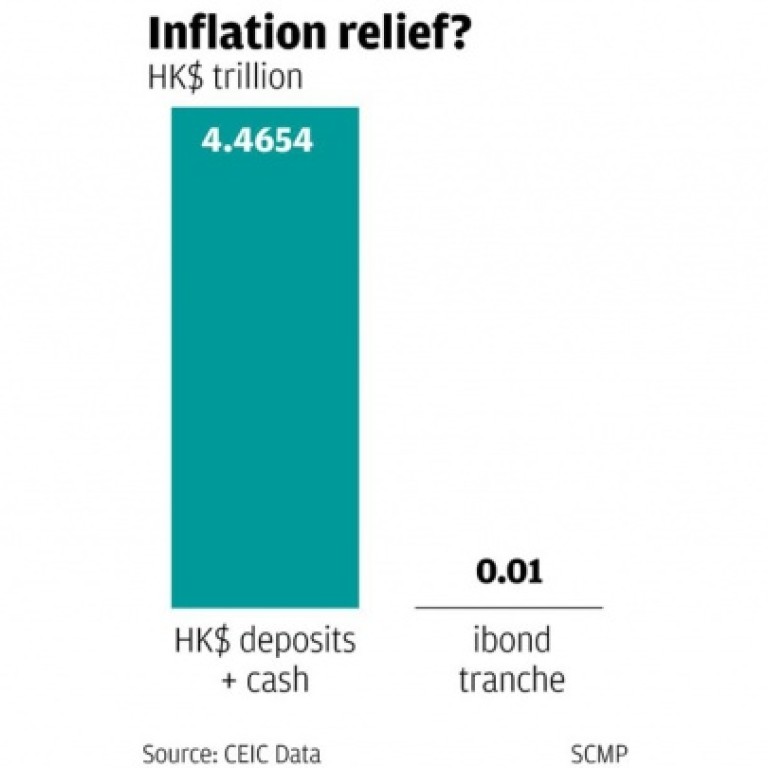

Let's put this into perspective and pardon me if you have seen the chart before but it tells the story too well not to repeat it. The first bar on the left represents the total of Hong Kong dollar deposits plus currency in circulation with the public. The second bar represents a HK$10 billion iBond tranche. Can you see the second bar?

You can? Then tell your optometrist she was a liar to say you needed glasses. I can't see it. But that bar, relative to the first, gives you the real picture of just how much the iBond helps reduce the impact of inflation on the people of Hong Kong.

It is actually nothing anyway. The extra yield over deposit rates will come from tax revenue. What the government puts in one pocket it takes out of another. In fact it is less than nothing. The full administration cost of making a bond issue only through the retail market is considerable.

The issue will be a big success, however, probably oversubscribed many times. Figure it out. For HK$100 you will get something like HK$110 back over three years as compared to HK$100 plus 0.00000001 per cent or maybe even less for a bank deposit.

And you won't have to wait for three years. These iBonds will be listed on the stock market. It's a no-brainer to calculate that their value will immediately jump on the market from HK$100 to about HK$106.

If you're one of the lucky applicants who gets a HK$10,000 allotment in the ballot for the winners you can then sell yours to your broker for an immediate profit of at least HK$500. There you have the cost of covered that same morning for you and the whole family. Anyone can play. What joy, what scope for envy.

Or, to put it differently, what a circus. Here is a lottery in which many people can win a little. How suitable to endless conversation in the housing estates, how diverting from the real problems of the day.

Oh yes, our financial secretary treads in well-trodden footsteps here.