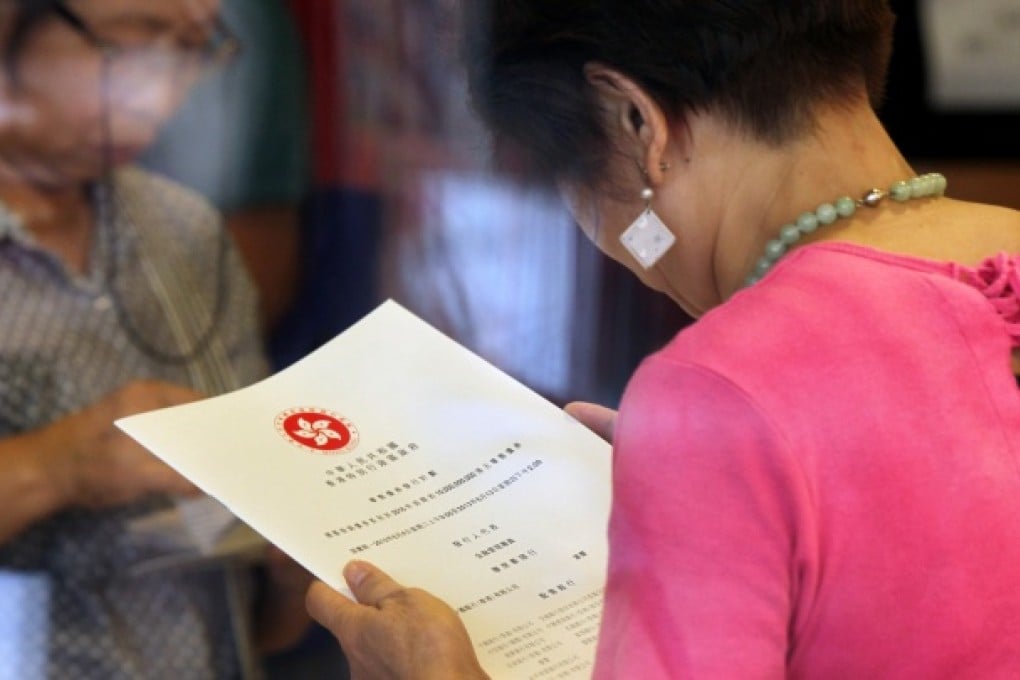

The first government iBond series was a great investment. The one that starts taking subscription this week will probably disappoint. That's because more people are waking up to its almost-sure profit, leading to a division of the pie that will probably leave only crumbs to investors - an allotment or two of HK$10,000 each.

It should be clear by now that the iBond has little to do with fighting inflation or promoting the development of a local bond market, as the government has claimed. The total amount of Hong Kong dollars in circulation and in deposits completely dwarfs the HK$10 billion iBond tranche the government is issuing.

But it is, let's face it, a not-too-subtle handout to placate the middle class, started by the highly unpopular administration of former chief executive Donald Tsang Yam-kuen and is now being aped by his even more unpopular successor Leung Chun-ying.

The first iBond in 2011 was highly profitable. Investors received full subscription of up to HK$440,000; more than 6 per cent in the first interest payment; and more than 5 per cent in the second payment. It also shot up 6.7 per cent on its first day of trading, a tidy profit for those who didn't want to hold the bond. This was, of course, a complete surprise to most market pundits, who were almost uniformly negative or uninterested.

Allotments got smaller in the second iBond series last year as more than 330,000 people subscribed with the subscription total amounting to HK$50.2 billion, compared to HK$13 billion in 2011.

Now, even more people will subscribe to the latest series, and inflation is lower. Investors in 2011 were first-time lucky because of several factors. Fewer people wanted iBond then because many distrusted Tsang's government for whatever it did.