Monitor | A property slump will affect the whole of Hong Kong's economy

Last week Monitor argued that the gradual tapering of quantitative easing and the eventual increase in American interest rates that will follow are likely to trigger a slump in Hong Kong property prices of 30 per cent or more.

Last week Monitor argued that the gradual tapering of quantitative easing and the eventual increase in American interest rates that will follow are likely to trigger a slump in Hong Kong property prices of 30 per cent or more.

That might sound like a good thing. Lots of families would like to buy. But with the minimum down-payment on a typical Hong Kong flat now equal to four years of median household income, many have been priced out of the market. To them, forecasts of a property slump are welcome.

But property prices do not fluctuate in isolation. In a city where the property market contributes a fifth of our gross domestic product, a big fall in prices will inevitably affect activity in all other sectors of Hong Kong's domestic economy.

First of all, a property bear market will erode consumer demand. With residential mortgage debt currently standing at 46 per cent of Hong Kong's GDP, a decline in the value of flats would have a big effect on household balance sheets.

For the hundreds of thousands of families paying off a mortgage on their flat, a fall in property prices would undermine the value of their assets relative to their liabilities, making them less inclined to go out and spend. That's not all. Falling property prices - and even the fear of falling property prices - will also affect the stock market, as the share prices of developers take a beating.

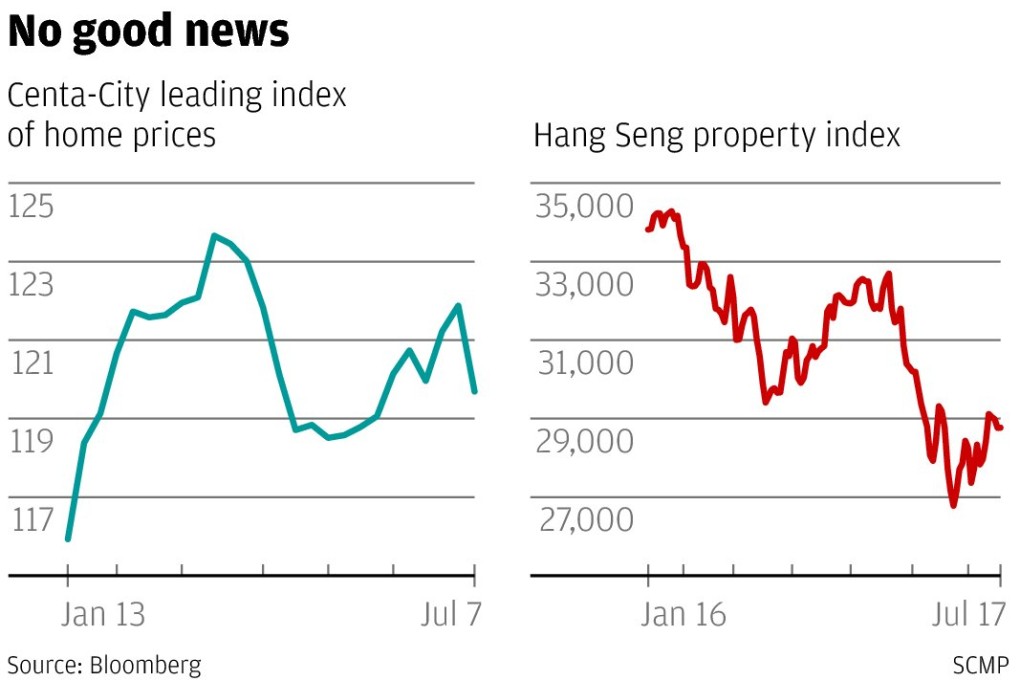

We've seen this factor at work recently. Even though home prices are up by 3 per cent over the last six months, the Hang Seng properties index of leading developers and landlords has dropped 15 per cent as investors anticipate falling profits over the next couple of years (see charts).