A property slump will affect the whole of Hong Kong's economy

Last week Monitor argued that the gradual tapering of quantitative easing and the eventual increase in American interest rates that will follow are likely to trigger a slump in Hong Kong property prices of 30 per cent or more.

Last week argued that the gradual tapering of quantitative easing and the eventual increase in American interest rates that will follow are likely to trigger a slump in Hong Kong property prices of 30 per cent or more.

That might sound like a good thing. Lots of families would like to buy. But with the minimum down-payment on a typical Hong Kong flat now equal to four years of median household income, many have been priced out of the market. To them, forecasts of a property slump are welcome.

But property prices do not fluctuate in isolation. In a city where the property market contributes a fifth of our gross domestic product, a big fall in prices will inevitably affect activity in all other sectors of Hong Kong's domestic economy.

First of all, a property bear market will erode consumer demand. With residential mortgage debt currently standing at 46 per cent of Hong Kong's GDP, a decline in the value of flats would have a big effect on household balance sheets.

For the hundreds of thousands of families paying off a mortgage on their flat, a fall in property prices would undermine the value of their assets relative to their liabilities, making them less inclined to go out and spend. That's not all. Falling property prices - and even the fear of falling property prices - will also affect the stock market, as the share prices of developers take a beating.

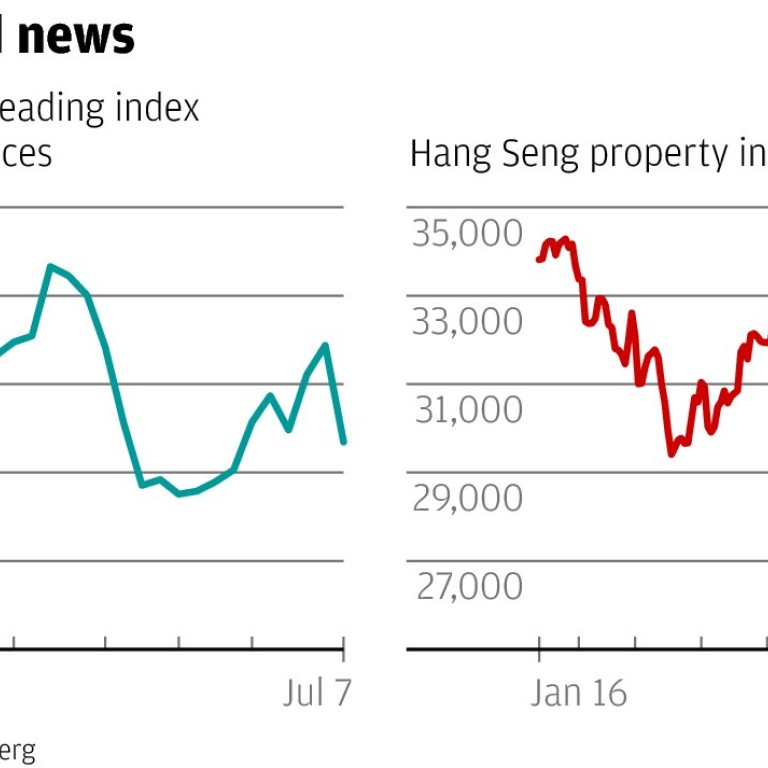

We've seen this factor at work recently. Even though home prices are up by 3 per cent over the last six months, the Hang Seng properties index of leading developers and landlords has dropped 15 per cent as investors anticipate falling profits over the next couple of years (see charts).

That hurts, because a weaker stock market makes investors feel less wealthy, adding to their reluctance to spend on big-ticket discretionary purchases.

Together, the direct impact of falling home prices and the indirect effect of a weak stock market can make a significant difference to consumer behaviour.

According to Marcella Chow at Bank of America Merrill Lynch, a 15 per cent decline in Hong Kong property prices relative to the prices of other goods and services knocks between 1 and 1.5 percentage points off the growth of private consumption spending.

A weak property market also hits investment. Most obviously, falling sale prices mean thinner margins for developers, which make investment in new construction projects less attractive.

But there is a second order effect, too. A softer property market weakens companies' balance sheets and chips away at banks' asset quality.

That makes companies nervous of investing, and banks less willing to lend to fund investments, especially in a city where the owners of small companies commonly put their own flats up as collateral against business loans.

Putting these two effects together, Chow estimates that a 15 per cent decline in the property market cuts private investment by almost 4 percentage points.

A decline in the value of flats would have a big effect on household balance sheets

On top of that, falling property prices eat into the revenues of the Hong Kong government, which both directly and indirectly relies on the property market for as much as a third of its income.

That shouldn't trouble officials too much, considering they have enough accumulated reserves to cover years of budget deficits.

Even so, the overall effect of a slump in the property market on Hong Kong's economy would be severe.

Chow is forecasting a 5 per cent decline in property prices this year, followed by a 15 per cent fall next year; a fall she expects to knock a full percentage point off the city's GDP growth in 2014, reducing it from 3.8 per cent to just 2.8 per cent.

So maybe a property market correction isn't such good news after all.