Tide turns on emerging markets

Nicholas Spiro says while recent investor flight from emerging markets is unlikely to become a rout, it is worrying that the sell-off has been this disorderly - before any 'tapering' by the US Fed

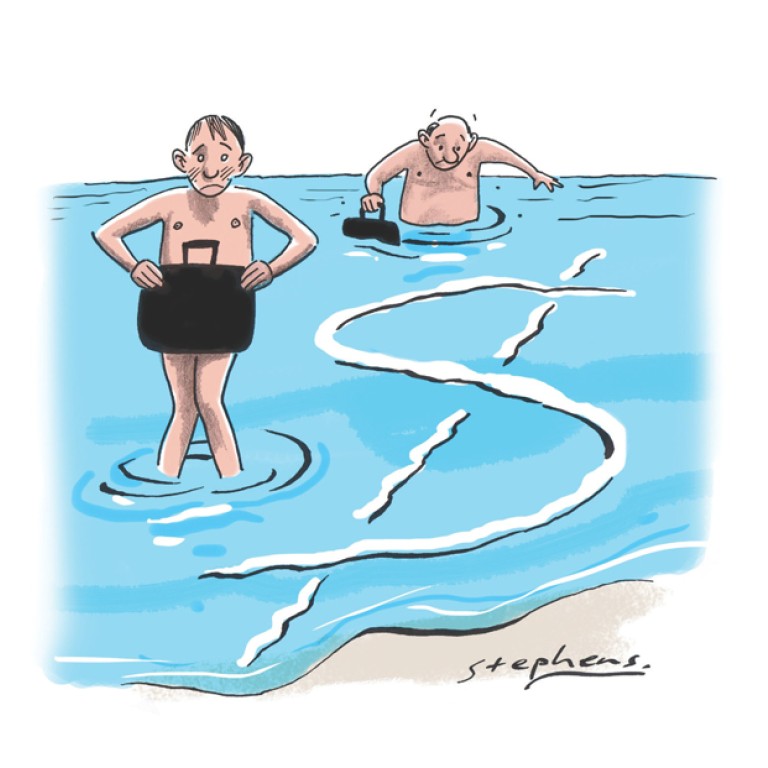

"Only when the tide goes out do you discover who has been swimming naked." Warren Buffet's famous phrase rings especially true for the financial turmoil that has engulfed emerging markets since the US Federal Reserve hinted in late May that it planned to scale back, or "taper", its programme of quantitative easing.

Developing economies with large external imbalances or whose prospects for growth have deteriorated (or both) have been hit the hardest in a disorderly sell-off which shows no signs of abating. Last week was particularly brutal, with US$2 billion gushing out of emerging markets bond funds - the 14th consecutive week of outflows - and US$4 billion pouring out of emerging markets equity funds, according to data provider EPFR.

While emerging markets whose underlying fundamentals are relatively strong have not been immune from the sell-off, those with large current account deficits which need to be financed by money from abroad have been penalised by investors. While the list of vulnerable emerging markets is extensive, India, Turkey, Indonesia, Brazil and South Africa have all taken a beating.

These "deficit" countries - as opposed to the surplus ones such as China, the Philippines, Hungary and Kazakhstan - are the most vulnerable to the shift in capital from developing economies to developed ones. While Fed tapering fears were the trigger for the deterioration in sentiment towards emerging markets, the sharp rise in benchmark US Treasury yields has shone the spotlight on weaknesses within the emerging market asset class.

Three failings in particular stand out. The most conspicuous one is the inability - or unwillingness - of policymakers to stop the rot. Instead of raising interest rates to a sufficiently high level to stabilise their currencies and stem capital outflows, Indian and Turkish policymakers have been dithering and tinkering at the edges for fear of endangering growth. While this is understandable, their lack of resolve is now a major contributing factor to the sell-off.

The second major weakness is structural. The emerging markets which are suffering the most right now are the ones whose reform agendas are the most incomplete. Economic, regulatory and institutional shortcomings in many were never meaningfully addressed by policymakers and were masked by the surge in capital flows to emerging markets over the past several years. The "hunt for yield" on the part of investors eclipsed long-standing country-specific weaknesses.

The third big risk is external. A toxic combination of rising US interest rates and geopolitical risks stemming from possible US military intervention in Syria is further souring sentiment towards emerging market assets and boosting demand for "safe haven" investments, such as the Japanese yen. Policymakers in emerging markets have been putting pressure on the Fed to be more mindful of the market dislocations caused by the central bank's exit from quantitative easing.

Still, fears of a repeat of 1994, when emerging markets suffered a full-blown crisis after the Fed stunned markets by raising interest rates aggressively, are way overblown.

Firstly, the emerging market asset class as a whole is better placed to manage the fallout from the sudden shift in US monetary policy. Most emerging markets now have investment-grade credit ratings, operate flexible exchange rate regimes and have much lower levels of foreign-currency-denominated debt. Indeed, risk perceptions have changed significantly since the 2008 global financial crisis, with many emerging markets enjoying higher credit ratings and lower credit default swap spreads - a gauge of the cost of insuring against a debt default - than several developed economies.

Secondly, investors have become more discerning and are adopting a more discriminating approach this time. Even within the "deficit" group of countries, markets whose external imbalances are smaller and whose underlying economic fundamentals are stronger, such as Poland and Mexico, have fared relatively well since the financial turmoil erupted in late May. While investors were not discriminating enough when emerging market equity and bond markets were buoyant, they are more selective now - and have by no means thrown in the towel on emerging markets.

Much of the foreign capital that has left emerging markets over the past three months or so has been retail and high-net-worth individual money. Large institutions, or so-called "real money" investors, have sat tight and maintained their exposure (although there are indications that even these investors are having second thoughts when it comes to the most vulnerable markets). This is not a fully fledged retreat, at least not for the time being.

The big question is whether the current sell-off will eventually turn into a full-blown rout. The fact that markets which benefited the most from the ample liquidity provided by central banks are now experiencing the sharpest sell-offs suggests that this is a correction as opposed to a financial meltdown.

However, much hinges on the Fed's exit from quantitative easing. That it has proved this disorderly even before the Fed begins to taper its asset purchases, to say nothing about increasing interest rates, is cause for serious concern.