Developers misread market for flats

I have often said here that in matters of housing our politicians and bureaucrats are three to four years behind the times. They flood the market with supply at the peak, only to make the subsequent collapse worse and they choke it off at the bottom, only to make the subsequent shortage worse.

I have often said here that in matters of housing our politicians and bureaucrats are three to four years behind the times. They flood the market with supply at the peak, only to make the subsequent collapse worse and they choke it off at the bottom, only to make the subsequent shortage worse.

The record, however, shows that private developers are not much better at timing. SHK Properties' timing calls were certainly spot on the money in the 1980s.

But this latest talk from Thomas Kwok has too much of the ring of a dedicated follower of fashion.

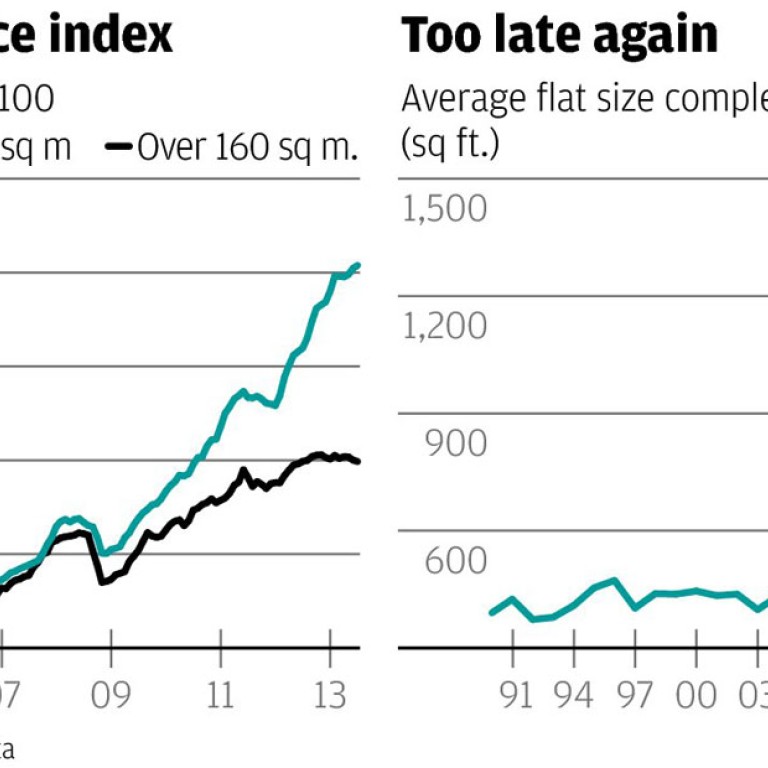

Take the evidence of the first chart. It shows a significant shift in the property market in October 2007, just when the Hang Seng Index reached its record peak and the beginnings of a financial crisis made themselves felt.

From that point onwards, prices of small flats (40 square metres and less) began to rise faster than prices of large flats (160 square metres and more). Previously the running had all been with the large flats.

Take note here that this chart shows an index of property prices, not actual property prices.

In price terms, the prices per square foot of big flats in October 2007 were about 150 per cent greater than those of small flats. That margin is now only about 50 per cent.

The last time that prices of big and small flats were the same on a per square foot basis was back in 1990.

Small flats may be playing catch-up now but there is no guarantee that they will ever reach parity again.

All we can say is that they are rising faster and that prices of big flats are, in fact, beginning to tail off a little.

That recent weakness in the top end of the market most likely has to do with the new stamp duty and other restrictive measures that the government has imposed to quell the boom in property prices.

They have held down prices for the rich and directed the price pressure to the poorer end of the market.

What an outstanding irony.

But now here is the point about the developers.

You would have thought that knowing the property market inside out, as they are supposed to know it, they would have seen this pricing shift from big to small flats coming, so that by now all the projects they are bringing to the market would feature small flats.

Not a bit of it. Take the private residential square footage completed divided by the number of residential units and you get the second chart. They read the tea leaves wrong three to four years ago and went for the big flats.

So when Thomas Kwok now says he is following the trend to small flats, I wonder whether it isn't time to change course and go for big flats again.