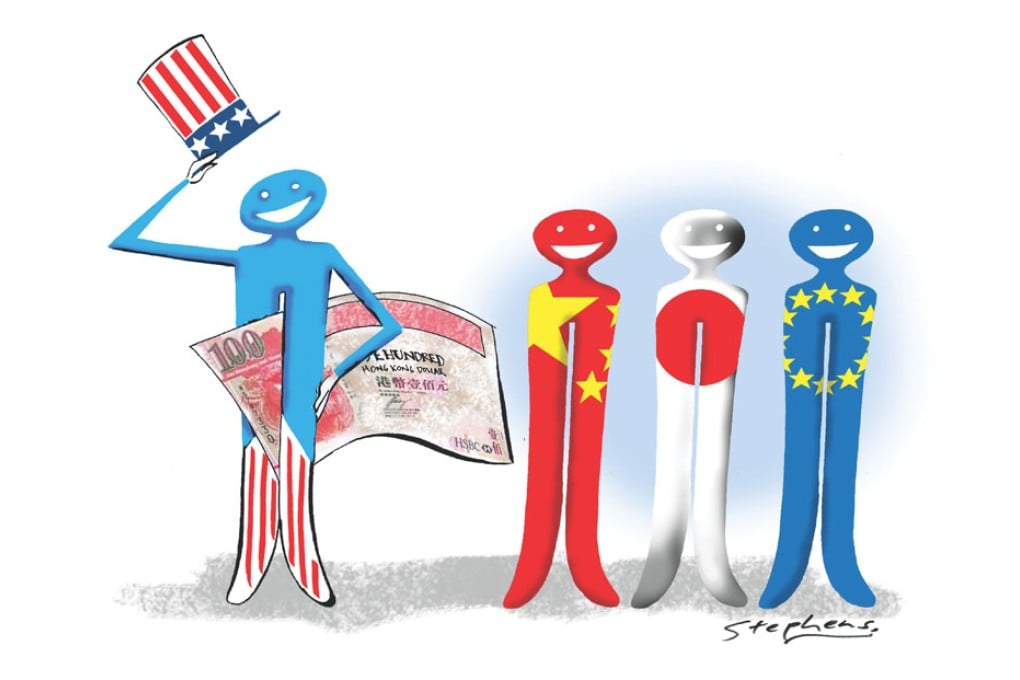

30 years on, Hong Kong's dollar peg is still a star performer

John Tsang says given the important role that the linked exchange rate system has played - and continues to play - in Hong Kong's rise to international economic and financial prominence, there is no reason to change it. John Greenwood agrees, noting the lack of an alternative: a flexible rate system won't protect the economy from volatility, while the renminbi is far from ready as an international currency

Today marks the 30th anniversary of the linked exchange rate system. For 30 years, it been the cornerstone of Hong Kong's monetary and financial stability. The system has been tested through different economic cycles and financial crises, and has continued to work well for us. Today, it is an integral part of our daily life.

After all these years, some of us may have only vague memories of the anxiety in the community when the Hong Kong dollar depreciated sharply prior to the adoption of the linked exchange rate system. Let me take this opportunity to restate the system's benefits and its importance to Hong Kong.

In 1983, Hong Kong had a floating exchange rate system. The Sino-British negotiations on the future of Hong Kong were going on and there was a rapid deterioration in market confidence in the local economy. This sentiment led to a sharp depreciation of the Hong Kong dollar.

Worried Hong Kong people scrambled for groceries and food staples. Even toilet paper became a target of panic buying. I was then the assistant district officer in Sha Tin, having just joined the civil service. This experience left a deep impression.

The linked exchange rate is a simple, clear, highly transparent and rule-based system

It was against this background that the linked exchange rate system was introduced. The community calmed down after it was put in place and the Hong Kong dollar was effectively stabilised. This clearly showed how a stable exchange rate is closely related to our community's daily life.

The system has successfully maintained exchange rate stability and provided a stable monetary and financial environment that is crucial to our trade-dependent economy. Our import and export trade transactions are mostly denominated in US dollars. With the peg, it is much easier for businesses to estimate costs and determine pricing, since they need not worry about potential losses due to exchange rate fluctuations. They can also save costs for hedging against exchange rate volatility.