China is waking up to the benefits of good diplomacy in Asia

Lanxin Xiang says China, for so long blinkered by a puffed-up sense of self-importance, is finally seeing the value of engaging with its neighbours for peace and mutual gain

Xi Jinping presided over a key conference recently on China's relations with neighbouring countries, or its "periphery policy" (zhoubian zhengce). The level of attendance, including all Politburo members working in Beijing, was the highest in recent memory.

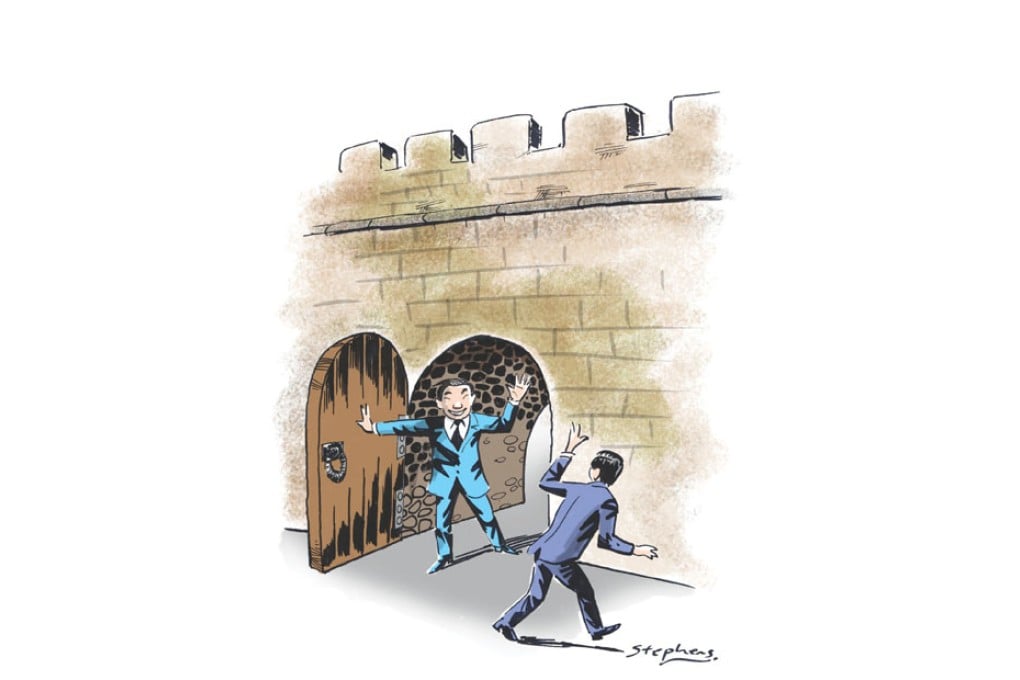

Most important was Xi's tone-setting speech, calling for improved relations with all neighbours through a long-term strategic vision, summarised through principles expressed in four Chinese characters: intimacy, honesty, benefaction and tolerance.

This conference was long overdue. Although it was not the first time Chinese leaders have vowed to improve ties with neighbours, most statements have been presented in a condescending manner, as if China were a benevolent outsider. This conference reflected a quantum leap in Chinese diplomatic mentality.

For a long time, China has lacked a serious and integrated "periphery strategy" for dealing with its neighbours. Chinese diplomacy has focused on great power politics; the Asia-Pacific as a region was considered to have only secondary importance.

Two historical legacies contributed to this condescending mentality.

First, there was the traditional "middle kingdom complex", often demonstrating itself in an obvious nostalgia for the traditional and Sino-centric international relations system known as the "tributary system", in which neighbours went to China for help and the emperor would demonstrate paternal benevolence but would never travel abroad.