China must continue reforming IPO rules

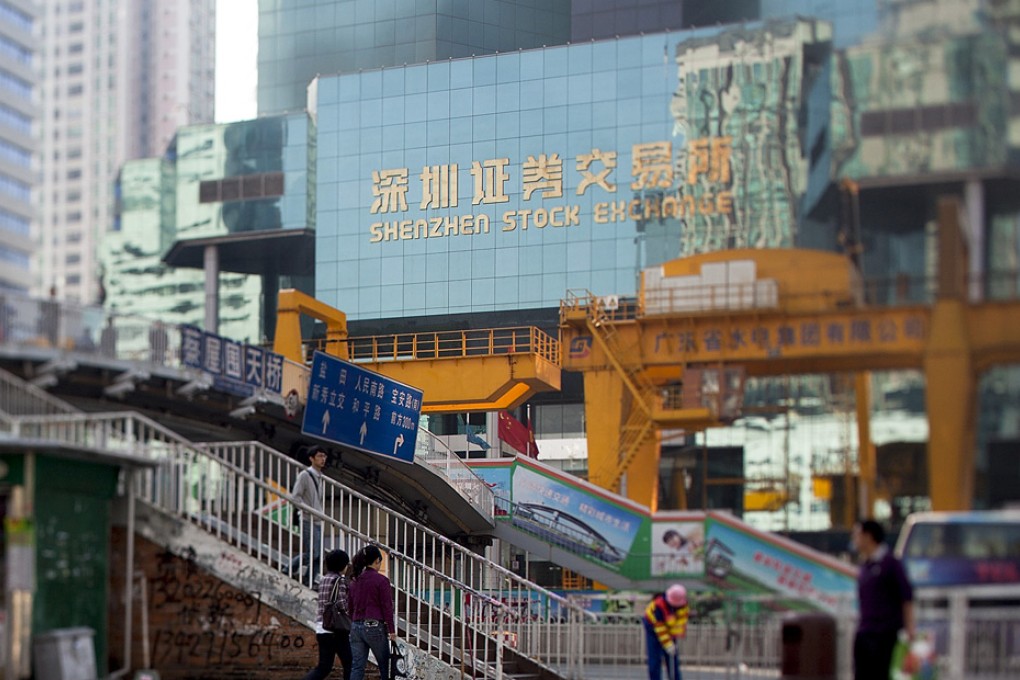

Just three years ago, China's market in domestic initial public offerings was worth around US$70 billion. It plunged to US$40 billion in 2011 and US$14 billion last year before the securities watchdog froze new listings amid a crackdown on fraud and misconduct among advisers. News of an imminent end to the IPO drought under a revamped regulatory regime is welcome, although the drain on liquidity could be a further drag on a lacklustre mainland A-share market.

Just three years ago, China's market in domestic initial public offerings was worth around US$70 billion. It plunged to US$40 billion in 2011 and US$14 billion last year before the securities watchdog froze new listings amid a crackdown on fraud and misconduct among advisers. News of an imminent end to the IPO drought under a revamped regulatory regime is welcome, although the drain on liquidity could be a further drag on a lacklustre mainland A-share market.

The China Securities Regulatory Commission says it will soon issue detailed rules to govern an IPO system based on a market disclosure regime instead of a drawn-out process of approval by regulators. To be implemented gradually, it will cut red tape and speed up applications. With more than 750 firms queued to launch IPOs on the A-share market, an initial batch of about 50 could complete the new registration process in time to list by the end of next month.

The watchdog says the reforms are aimed at making the listing process more responsive to market demand. In other words, if they are carried through, market forces rather than unaccountable officials will now decide the fate of IPOs on their merits, not the strength of their political connections. That is a step in the right direction. Insider trading and other malpractices have become rife as a result of government intervention in the market to control IPO pricing and structure. But there is a long way to go before mainland markets shed their notorious casino image of a cash machine for state-owned enterprises that sucks money out of gullible small investors. The CSRC needs to maintain a sustained effort to improve accountability and transparency so that big and small investors alike get a fair deal.

Given the importance of sustaining strong economic growth, China cannot afford doubts over a level playing field and underwhelming performance in its equity markets. Favourable treatment for politically connected companies that fail to meet expectations and a tolerance of disregard for laws and rules must end.