Jake's View | Tsang's budget concerns for Hong Kong ones most cities wish they had

Let's consider this revenue problem as we do indeed suffer from one. It is so severe that, as of the latest figures, it has resulted in our government running a fiscal surplus at an annual rate of HK$52 billion.

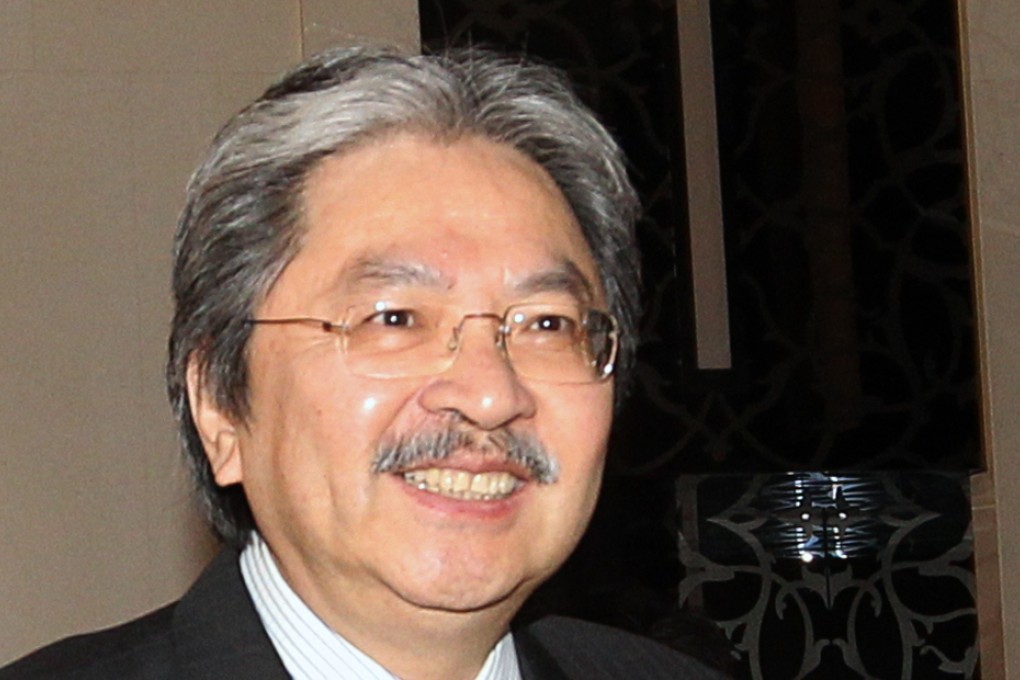

Financial Secretary John Tsang Chun-wah issued a stern warning that revenue from taxes must rise if the city is to cope with rising expenditure brought about by an ageing population.

Let's consider this revenue problem as we do indeed suffer from one. It is so severe that, as of the latest figures, it has resulted in our government running a fiscal surplus at an annual rate of HK$52 billion.

This is a surplus, not a deficit, I hasten to remind you and it amounts to about 2.5 per cent of gross domestic product. Governments around the world would salivate to enjoy so strong a fiscal position. Mostly they struggle to keep their deficits to less than 3 per cent of GDP, a commonly accepted benchmark for the outside limit of fiscal prudence. Mostly they fail.

And fiscal surplus is not unusual for us. Over the last 31 years, which is as far back as I have data, we have enjoyed a surplus for three out of four years. Only for a brief period at the height of the 2002-03 difficulties did we suffer a deficit of more than that benchmark 3 per cent of GDP.