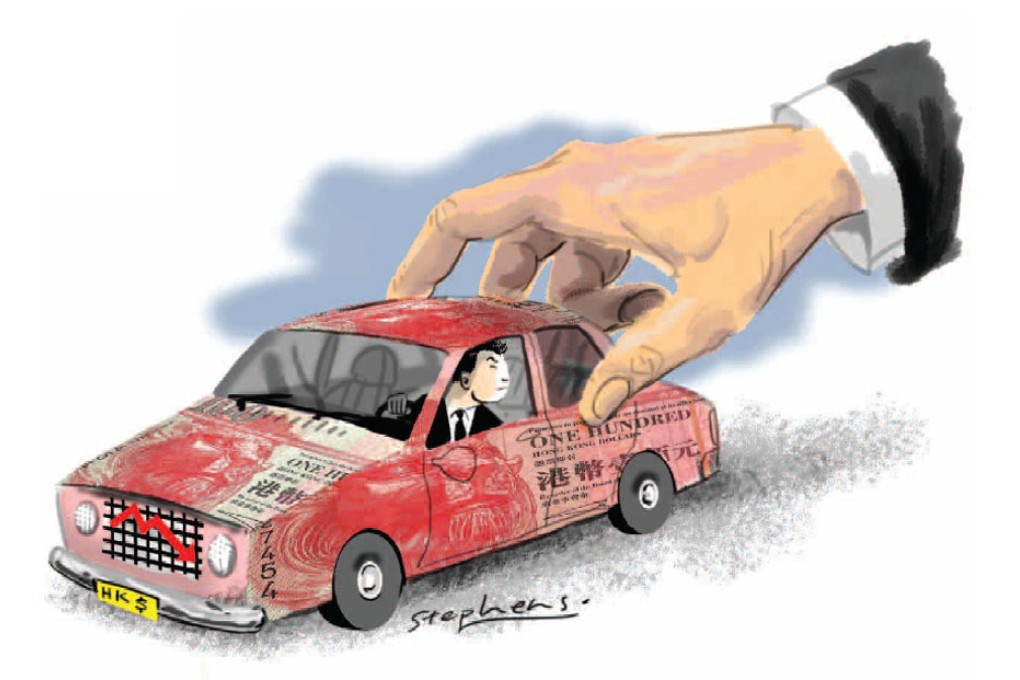

Government must back off to keep Hong Kong a truly free market

Lam Pun-Lee esays Hong Kong's standing as a free market is being undermined by its own government, with its intrusive restrictions on property and other sectors that hurt growth

Hong Kong's economy has always been a global stand-out, rated the world's freest for 20 consecutive years in a ranking compiled by the US-based Heritage Foundation and The Wall Street Journal. However, with a drop in the score for corruption and increasing government control over land policies as well as factors limiting the flow of information, the gap to the others - notably Singapore - has narrowed further.

This trend is worrisome.

A case in point is the property market. In the decade following the 1997 handover, Hong Kong's property market experienced unprecedented volatility due to some obvious political factors in a government-policy-driven market.

Hong Kong is a densely populated city, where land supply is controlled by the government. Land supply influences the supply of housing and property prices, which means that the real estate market cannot be considered a truly free market. Furthermore, the Monetary Authority can exercise influence over bank mortgage policies, significantly affecting transaction volumes and pricing.

After the handover, housing measures implemented by then chief executive Tung Chee-hwa failed to resolve the effects of the Asian financial crisis. Tung's pledge to provide 85,000 flats each year caused the market to crash. His subsequent bailout in 2002 through a restriction on land and property supply then drove prices up; since 2003, they have more than tripled.

After Donald Tsang Yam-kuen took over in 2005, no land reserves were established. This left the government with insufficient land to meet market demand, causing prices to climb further since 2009.

Given the short-term housing supply shortage, the government could only rely on demand management measures and the tightening of mortgage rules to suppress demand. While initial policies were aimed at reducing speculation and the sale of luxury housing, the tightening of mortgage rules and increased stamp duty on luxury premises prompted speculators to divert their investments to small and medium-sized homes, as well as commercial buildings.