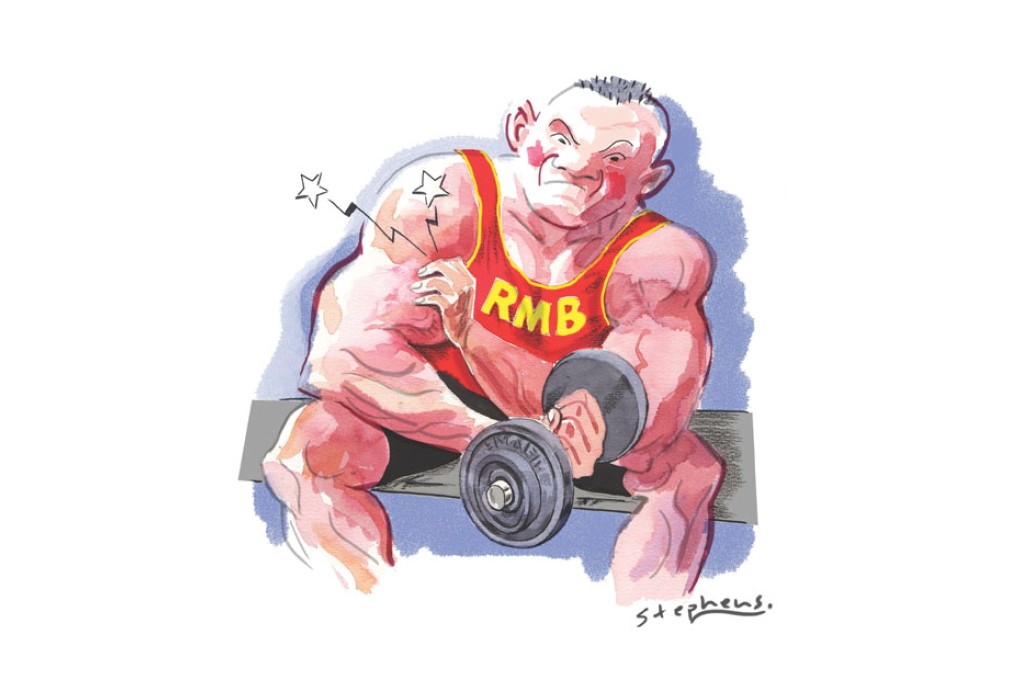

Renminbi's volatility simply growing pains of emerging international role

Dan Steinbock says fluctuations in the Chinese currency is not a sign of long-term weakness but part of the growing pains it must endure as its importance develops in international finance

The recent volatility of the renminbi does not herald its weakening, but the increasing opening of the currency and still another milestone in its international ascent.

After a sharp depreciation in China's currency since the beginning of this year, the United States, early this month, warned Beijing not to manipulate it , ahead of IMF, World Bank and G20 meetings to be held in Washington.

In turn, International Monetary Fund managing director Christine Lagarde warned of a risk of a "hard landing" in China, which led to a prickly debate with China's deputy finance minister, Zhu Guangyao . After these meetings, the US Treasury slammed Beijing even harder on currency.

Ironically, as Beijing has initiated the most extensive and deepest reforms in three decades, it finds itself penalised, not rewarded, in the West.

In reality, the renminbi's volatility did not come out of the blue; nor was it the result of simple market forces. In part, it was engineered in Beijing - but as an integral part of the reforms, not against these reforms.

In the past two decades, the euro and, to a lesser degree, the Japanese yen have become important regionally. However, neither has been able to challenge the US dollar's dominance globally.