Pension debate throws up hard questions about financial burden

If an issue has been debated for a long time without a consensus, it means it is highly contentious; or decision-makers have just tiptoed around it. In the case of retirement protection, it is both. After half a century, the need for a universal pension scheme is still on the public agenda in Hong Kong.

If an issue has been debated for a long time without a consensus, it means it is highly contentious; or decision-makers have just tiptoed around it. In the case of retirement protection, it is both. After half a century, the need for a universal pension scheme is still on the public agenda in Hong Kong.

It would be unfair to say officials have done nothing, though. After three decades of discussion, the British colonial government introduced a mandatory provident fund scheme in 1995, following an abrupt U-turn on the pension plan originally proposed for all elderly people. But the scheme is hardly enough to ensure a decent life in retirement. Tens of thousands outside the workforce are also left out.

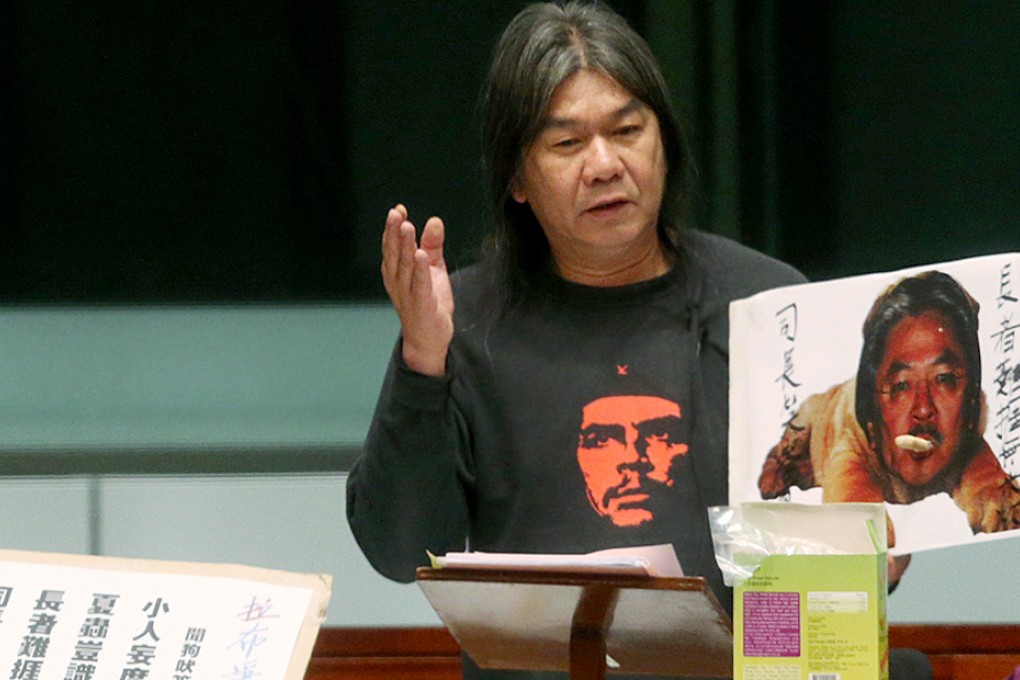

With the filibuster pushing for a universal protection scheme coming to an end in Legco, Financial Secretary John Tsang Chun-wah took up the issue on his official blog. While acknowledging it was time for a review, he said the MPF scheme, despite its inadequacies, should not be scrapped.

Tsang may think his account of the debate over the past decades would help the public appreciate that successive governments have spared no effort in tackling a highly contentious issue.

But the public perception is that the government, having put in place minimal protection for the working population, does not have the will to go further.

A government-commissioned retirement-protection study will be tabled for discussion later this year. There have been suggestions that the existing monthly old age allowances - up to HK$2,300 - should be replaced by a higher monthly payment.