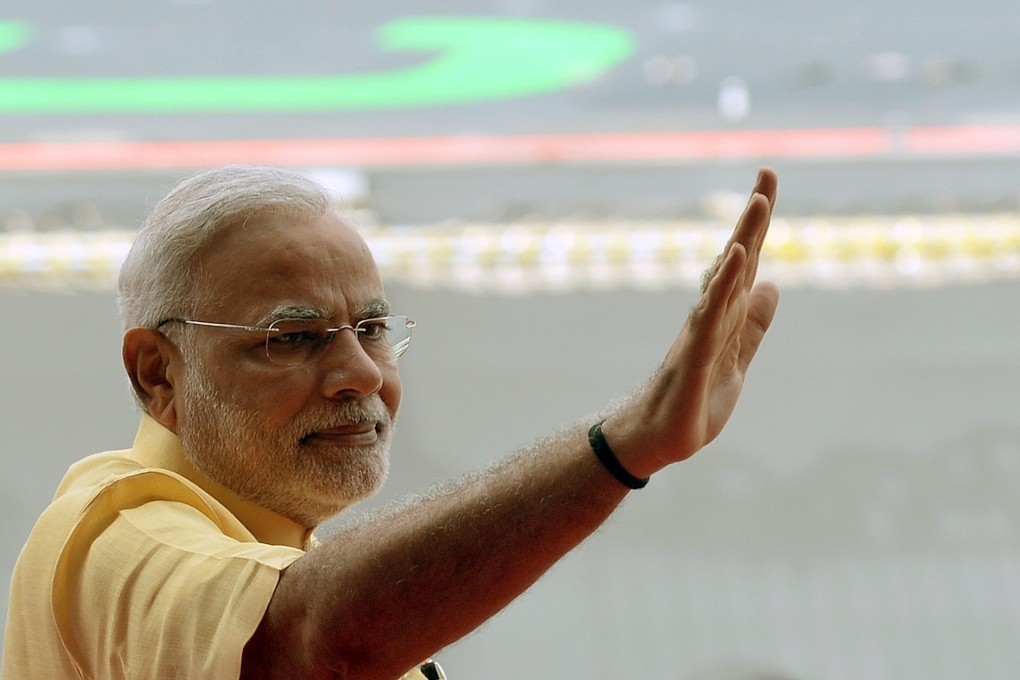

Macroscope | Too early to pass judgment on Modi

While cautious optimism replaces the unrealistic expectations for the new PM's agenda, investors continue to show confidence in India's prospects

Are financial markets losing confidence in Indian Prime Minister Narendra Modi, whose overwhelming victory in the country's parliamentary election in May was seen as providing a crucial impetus to much-needed economic reforms?

While it's still early days, the enthusiasm among investors has begun to wane somewhat over the past three months.

The "Modi-mania" that fuelled India's buoyant equity market in the run-up to the election is giving way to more cautious optimism about the prospects for meaningful reforms in India.

The big question is whether Modi can come up with a concrete plan to overhaul public finances

Having risen by a staggering 24 per cent this year, Indian equities are up just 1.5 per cent over the past month, compared with a rise of 3 per cent for both Latin American and emerging European stocks.

While the Indian rupee strengthened 7 per cent against the US dollar between the end of January and the end of May, it has weakened nearly 4 per cent since then - although partly as a result of recent financial jitters in emerging markets.

Doubts among investors began setting in when the Modi government's maiden budget, on July 10, fell far short of expectations, with little in the way of specific proposals to revive growth, impose fiscal discipline or help curb India's persistently high inflation rate, which reached nearly 8 per cent last month.

The government's fiscal credibility was called into question by its decision to duck the politically sensitive issue of overhauling India's mammoth US$43 billion state subsidy system yet stick to the outgoing government's overly ambitious 2014 fiscal deficit target of 4.1 per cent of gross domestic product.

What's more, in July Modi torpedoed a landmark World Trade Organisation deal to slash red tape at national borders due to concerns about food security.