The View | Alibaba runs on emotion, fundamentals have to wait

Alibaba's golden age may well last for some time, at least while emotion trumps stock fundamentals

The exotic and mysterious tales of One Thousand and One Arabian Nights featured one Ali Baba.

To cut a long story short, Ali profited from outwitting a den of Forty Thieves and naturally the good guys lived happily ever with both cash and love interest.

In a placing like this, the large institutional investors usually get in at the head of the queue. Their price was US$68, a figure already at the high end of the range.

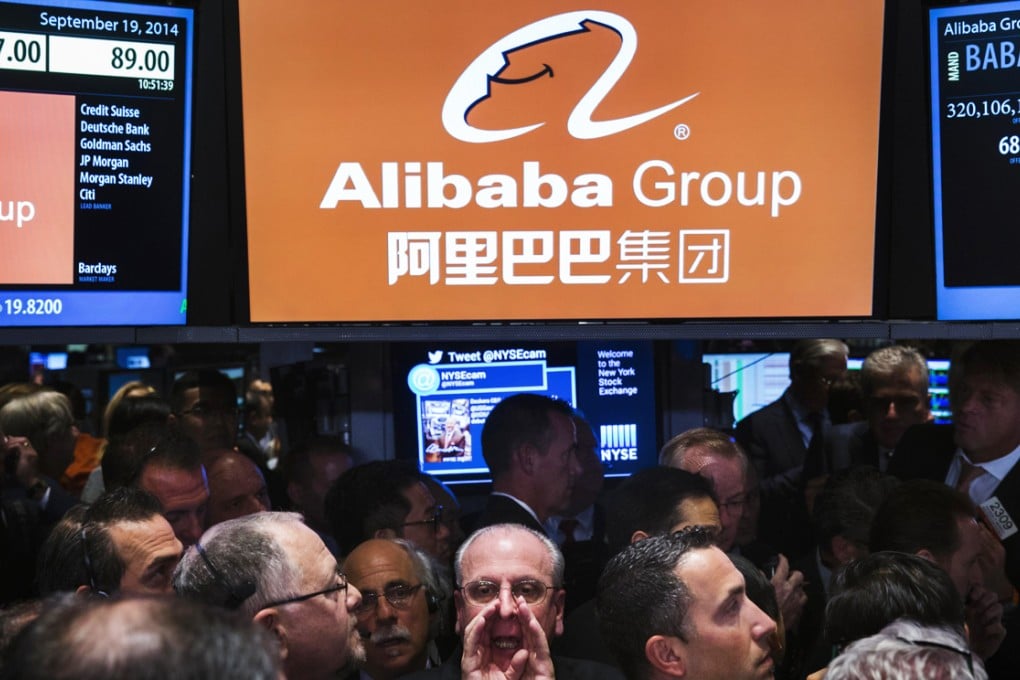

The process of matching the first bids and offers last Friday took three hours, with the opening price slowly creeping up until it was finally struck at a princely US$92.70. The stock traded throughout the afternoon to end at US$93.89. These fortunate investors made a comfortable 38 per cent gain on their shares with the little guys losing out.

But in an oversubscribed placing like Alibaba, even the big investors get scaled back. So the institutions aren't necessarily the big winners, as the millions made on the trade become a rounding error when you are running billions. Some institutions received no shares at all.