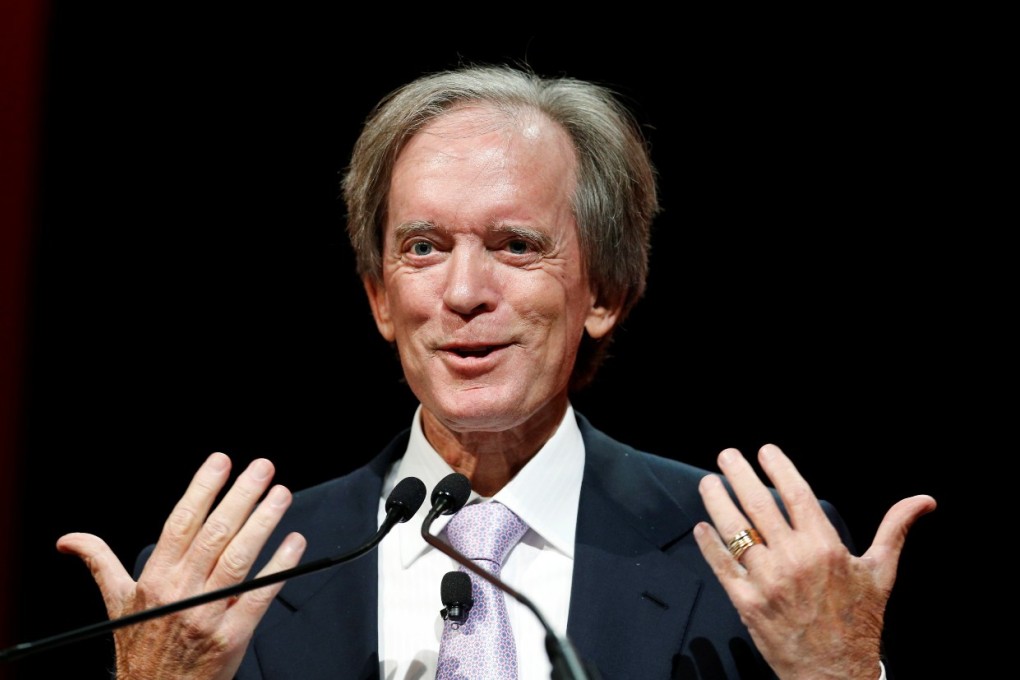

Fall of 'bond king' Bill Gross marks the end of an investment era

US political guru James Carville might have been thinking about Bill Gross when he once said he wanted to be reincarnated as the bond market so that "you can intimidate everyone".

US political guru James Carville might have been thinking about Bill Gross when he once said he wanted to be reincarnated as the bond market so that "you can intimidate everyone".

As the co-founder in 1971 and long-time investment chief of Pimco, Gross helped make the fixed-income mutual fund industry what it is today and heralded the three-decade bull market for bonds. His abrupt and acrimonious departure from Pimco last week truly marks the end of an investment era.

In the mid-1970s, at a time of double-digit inflation in the US, he made the brilliant call that rates were going to fall as a long-time trend. As bond prices move inversely to interest rates, this meant they would rise over time, thus starting a long-term bull run. With Gross at the helm, Pimco was frequently cited as the world's largest fixed-income mutual fund manager, with current assets worth US$2 trillion. For all this, he was rightly dubbed "the bond king". Investors hung on his every word; his newsletters were eagerly read. Perhaps only stock guru Warren Buffett has had a bigger cult following.

But Gross' star began to dim with the onset of the global financial crisis, which started in the US. The main problem for Pimco has been poor performance and continual investor fund outflow, which became especially acute in the past year. The problem was that the market Gross knew used to intimidate politicians; not any more, at least for now.

After the US and global crises, powerful central banks, led by the US Federal Reserve, kept intervening in the market to keep interest rates low. His call that the bond bull run was over, while sound in its pure market logic, was wrong-footed by policymakers. But when he later reversed his call and foresaw a longer period of low interest rates, the Fed signalled - and bond markets are pricing in - higher rates sooner than later.

It's central bankers who have been intimidating the global bond markets, the largest of which has always been in US Treasuries. And Gross has become their most famous casualty.