In the land of the free, Chinese companies come up against the long arm of the US law

William McGovern says a shift in the investment paradigm has exposed new risks of a day in court

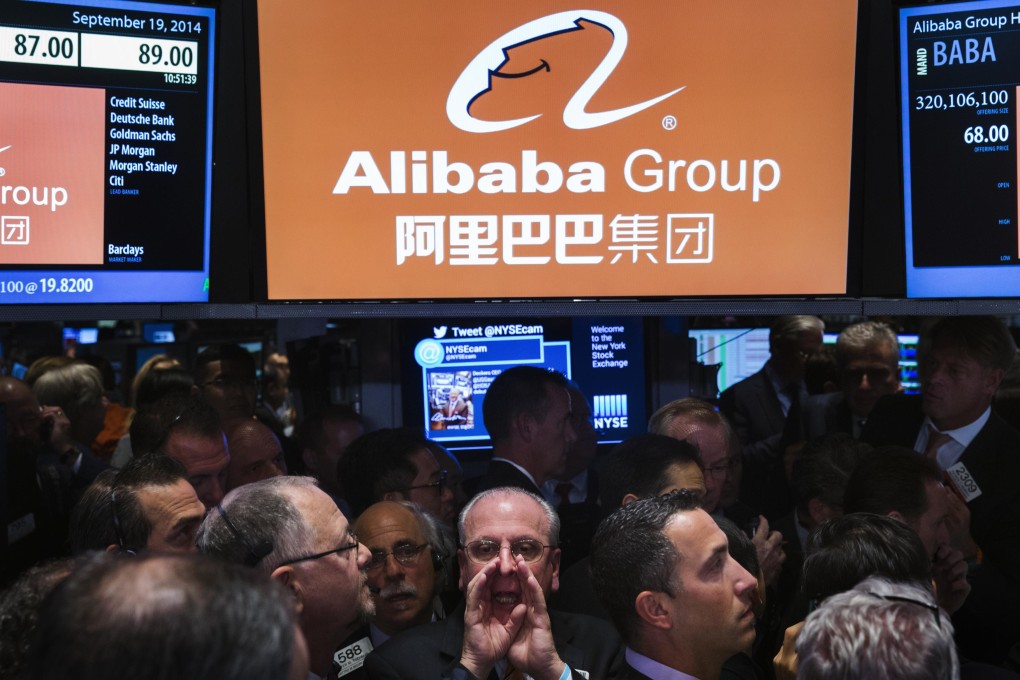

In the space of 133 days, Alibaba went from the world's largest initial public offering to the latest target of a US shareholder lawsuit. That journey signals a new era of litigation risk for Chinese companies seeking to grow in the US.

Chinese companies are investing in the US at record levels. Alibaba's US$25 billion public offering is the highest-profile example but consider also that Chinese investors have, in the past couple of years, purchased the iconic Waldorf Astoria in New York City, Smithfield Foods and AMC Theaters. While this unprecedented inflow of capital and ambition from China is reshaping America in many ways, the most profound impact may be on the ability to hold Chinese companies accountable in the US courts.

The US courts provide a robust framework for private parties to resolve disputes. When an individual or a company believes it has suffered losses at the hand of another, the answer is often to initiate a claim in the courts. The essential steps include filing a complaint in a court and serving it on the other side who can then be compelled to answer. This process is the central engine of commercial dispute resolution in the US. There were thousands of civil actions commenced in the US federal courts last year.

The sine qua non of US litigation is jurisdiction. A plaintiff must be able to show that the defendant has had sufficient minimum contact with the US such that the court's assertion of jurisdiction is deemed fair. Put simply, if you are living, working or regularly engaging in business in the US, you should expect to be hauled into court if you have caused harm to someone.

Under the "made in China, shipped to US" paradigm, US plaintiffs have had difficulty demonstrating that the Chinese manufacturer has sufficient contact with the US to be held accountable in the US.

In the new era, where Chinese companies are physically present in the US or contractually tied to joint venture partners, US plaintiffs can more easily demonstrate sufficient contact in the US to bring a claim. Taishan Gypsum Company, a Chinese drywall manufacturer, was forced to face claims from US homeowners related to its manufacture and sale of defective drywall. Taishan operates solely out of China and has no US presence, yet the court rejected its argument that the homeowners' claim should be dismissed for lack of jurisdiction - because it had a distribution agreement with a Florida company.