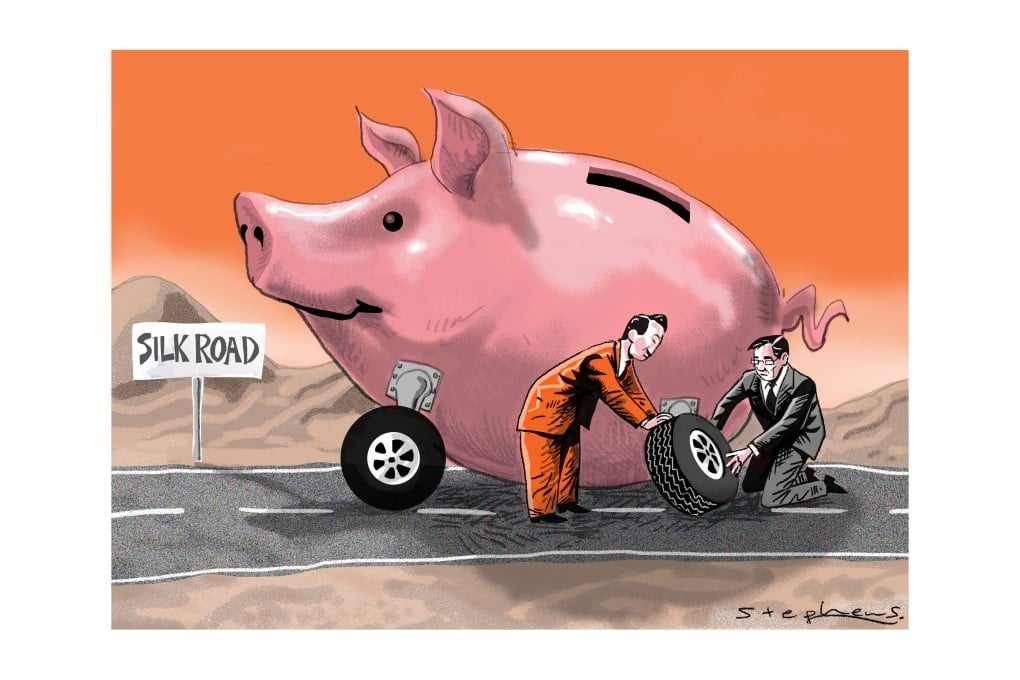

Let's not get carried away; Asian Infrastructure Investment Bank faces many hurdles

G. Bin Zhao says while the AIIB does have great potential, we should be aware that the China-led bank faces key challenges and difficulties from the outset

At the recent Asian-African Summit held in Indonesia, Indonesian President Joko Widodo said that those who still insisted that only the World Bank, the International Monetary Fund and the Asian Development Bank can solve global economic problems were adhering to outdated ideas, and establishing a new international economic order open to the emerging economies was imperative.

Although he did not directly mention the Asian Infrastructure Investment Bank, his views are highly representative of those held in Asian countries.

Earlier, when Britain, Germany, France, Italy and other major developed economies applied to join as founding members, the significance of the bank was greatly enhanced, but also exaggerated. For example, former US Treasury secretary Lawrence Summers claimed that "I can think of no event since Bretton Woods comparable to the combination of China's effort to establish a major new institution and the failure of the US to persuade dozens of its traditional allies, starting with Britain, to stay out of it". More extreme, some people think it marks the economic and political decline of the US and the end of the American century.

Although the potential role of the infrastructure bank has been touted and highly praised, it is important to remain calm and think objectively as the institution is still in its infancy. Particularly worthy of attention is the fact that China has no experience in independently creating and leading any large international organisations and therefore there are likely to be many difficulties and challenges at the outset. Specifically, in terms of corporate governance, organisational structure, management teams, business models and the like, the slightest mistakes may lead the bank to become an "abandoned child". Undoubtedly, learning from the successful experiences of existing international development banks may be the way forward.

I serve as the China consultant for a successful regional development bank - the European Bank for Reconstruction and Development. This experience allows me a unique perspective to examine several strategic choices that will be required as the Asian Infrastructure Investment Bank is established.

First, the key for the bank to be competitive and successful lies in adhering to market-oriented operations and achieving a triple-A credit rating as soon as possible to keep the cost of financing low. This is likely to be a relatively difficult task in the short term. China's own sovereign credit rating is only AA-, while the bank is a new institution, with the majority of its shareholding countries relatively less economically developed.

On the one hand, the guarantees provided by the shareholders might be considered relatively weak, on the other, with most of the infrastructure investment targets located in economically underdeveloped areas, the projects themselves can be expected to have high risks and unstable returns.