Howls of protest among China's stock market tricksters are likely to fall on deaf ears

Andy Xie says many ordinary folk have wisely avoided getting embroiled in the turmoil this time, leaving the leveraged scammers scrambling for government help

"History repeats itself first as tragedy, and then as farce." - Karl Marx, 1852.

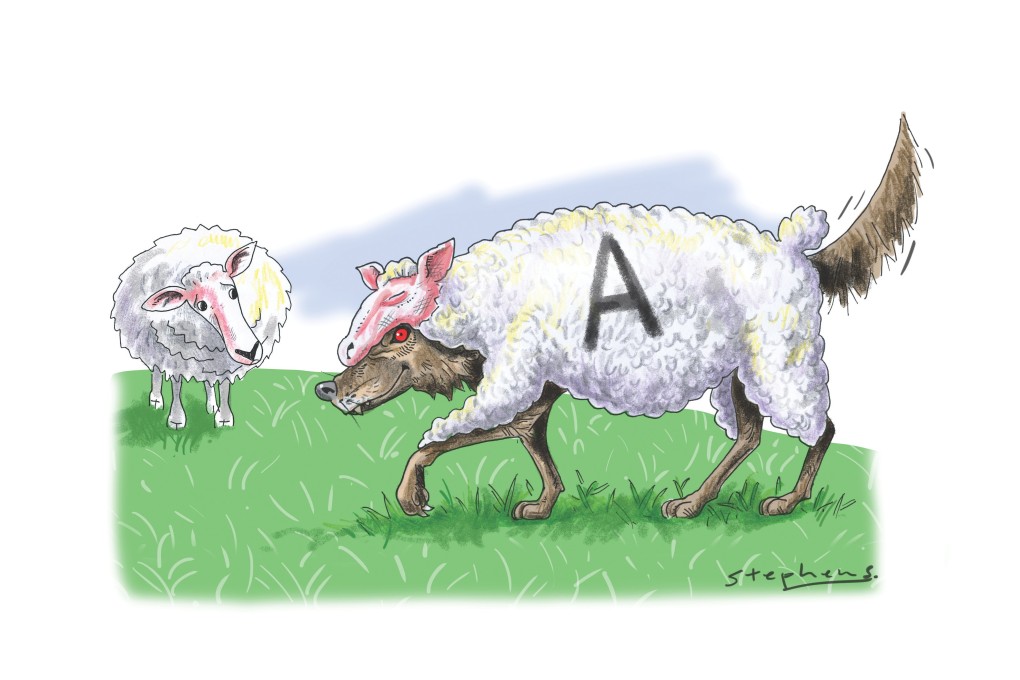

The A-share market is crashing. The financial media is frantically looking for saboteurs. Rumours are flying that desperate people are throwing themselves out of the window. When nothing works, the howls for a government bailout sound like hungry wolves at midnight. It feels like déjà vu; the noises are almost identical to what people heard after the market began to crash in late 2007. But, there is one big difference: not many ordinary people are talking about it.

Pianzi is a unique Chinese term. It has a similar meaning to swindler, scam artist or conman. Its uniqueness is that a pianzi often thinks he is doing his victims a favour. When someone buys a fake Rolex, if the person isn't aware it's a copy, they pay less for the same feeling, and the pianzi makes a fat profit. Isn't that good for everyone?

When the market began to rise last autumn, as usual, the big pianzi poured in first, and the little ones followed. They chuckled about the fools to come. To double up, they borrowed trillions of yuan to leverage up. Of course, the media noises were dominated either by those who were paid off or who joined the game of how to rob the little people.

Yes, fools came. But on the way to the slaughterhouse, most survivors of the previous games didn't show up. The ones who did show were the youngsters who had little money to be parted from. One day, all the pianzi suddenly realised that the market was just them; the dumb, fat lambs weren't going to come. Soon, it became a game of pianzi killing one another.

When people don't fall for the trap, the market turns to the other fat lamb - the government. To scare the government, social stability is always cited as the reason a bailout is needed. Usually, the government's first step is to stop the initial public offerings. But that only stops new pianzi from diluting the game. The real bailout is to find dumb money and in sufficient quantity. Will the government cough up? I seriously doubt it.