Risk/reward ratio for investors precarious on sex sites like Ashley Madison

Sex sells, and this has been the case for a very long time, not for nothing is prostitution called the world’s oldest profession. However as Avid Media, the owner of the Ashley Madison sex hook up site (other descriptions are available) is demonstrating, selling sex may well be lucrative but also distinctly problematic.

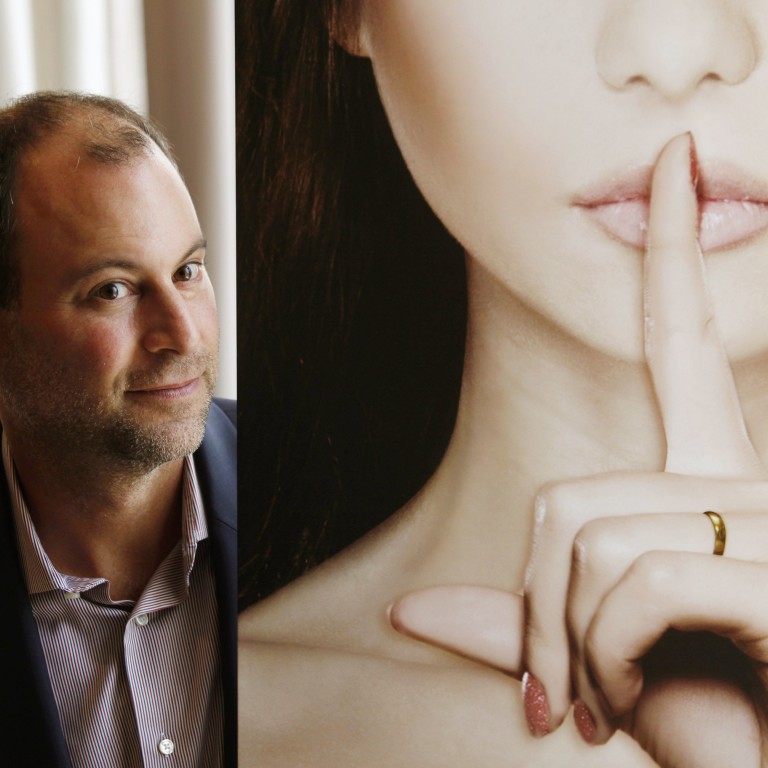

Last week Noel Biderman, Avid’s Chief Executive, was forced to resign in the wake of a hacking attack that threatens to reveal millions of user’s names, this in turn has spurred law suits against the Canadian company and now, surprise, surprise, it is alleged that there was some jiggery pokey about female profiles on this site.

Yet Avid registered sales of US$115 million last year and controversially claimed to have 39 million users. Other sex hook up sites do not reveal their revenues because, unlike Avid, they are not planning to go public.

However there are other ways in which sex sales over the Internet are thriving. The sex toy industry alone is estimated to command annual revenues of $15 billion and their products can be found in mainstream outlets such as Amazon. Then there are all manner of apps and other sites that do good business selling titillation, fantasy and, well, readers can fill in the gaps here.

Rather less transparent in terms of sales are the many pornographic sites that are hauling in cash and can claim to be pioneers of making money out of the net; indeed in the Internet’s early days it was believed that the only people likely to make real money out of cyberspace would be pornographers.

The Internet also caters for other vices; gambling springs to mind as an obvious example and the net is, in some ways, an ideal platform for vice as it is supposed to offer anonymity and has the benefit of vast coverage and easy accessibility.

The fact that Ashley Madison’s problems are a result of hacking, leading to a serious breach of that anonymity, comes as no surprise. Only the naivety of the site’s users should be a cause for wonderment. The basic fact remains that people with vices are vulnerable and the nature of the Internet makes them more, not less, vulnerable.

Therefore vice-associated businesses are high risk both for the users and the people who run them. This is not a moral issue but a statement of fact. Views on morality change over time but risk is risk and thus a constant factor and it is quite possible to price risk into any given equation.

The risk/price equation must surely be uppermost in the minds of Avid Media executives who were (and possibly still are) planning to float the company in London this year. Meanwhile the risk/reward equation has turned sour for companies such as Playboy and New Frontier Media, which had been listed but decided to go private again. Nevertheless Rick’s Cabaret, purveyor of so called ‘gentlemen’s clubs’, is still listed in the US.

Other so called ‘sin stocks’, primarily for gambling, alcoholic and tobacco businesses are rather more prolific on global stock exchanges. They also provide a telling illustration of how attitudes to sin keep changing. Alcohol, for example, was famously banned during America’s prohibition period, now not only is alcohol legal but more and more drinks companies are coming to the market. Tobacco is faring less well on many fronts and so-called ethical investors blacklist shares in tobacco companies.

Who knows if sex-related businesses will start becoming respectable anytime soon? If this is to be considered purely on a moral basis, then there is no problem because those with an objection to the exploitation of sex for business purposes will, hypocrisy permitting, stay well away. However it’s a fair bet that moral qualms are not disturbing investors who like the idea of financially dabbling in the intriguing world of sex.

My guess is that if they are tempted to put their money where their mouths are, they will find that once the sex industry goes to the level of being a large corporate enterprise, the risks become rather overwhelming.

When these sex businesses are scaled up and looking for investors, they face a quite different level of scrutiny and accountability that makes them highly vulnerable. Yet the heady combination of sex and money will find takers at every stage.

The Ashley Madison saga has added to the sum of human entertainment and kept newspapers busy but it also confirms the precarious nature of the risk reward ratio in the sex business showing, as if we didn’t know it, that sex and investment are a dangerous mix. Meanwhile as the saga rolls on, it is hard to avoid the vicarious pleasure that is to be had from the misfortunate of others – not much changes does it?

Stephen Vines runs companies in the food sector and moonlights as a journalist and a broadcaster