Over three decades of China’s breakneck economic growth, the environment has paid a heavy price. On a good day, Beijing’s air quality index (AQI) can be as low as 25 – on bad days it can climb to 500 or above, almost double the pollution level considered hazardous.

One study earlier this year found more than 80 per cent of Chinese are regularly exposed to pollution levels deemed unhealthy by the US Environmental Protection Agency, with air pollution killing about 4,000 people a day or accounting for about 17 per cent of all deaths in China.

This surge of pollutants not only has a direct impact on health, its burden on the economy and business is becoming increasingly apparent. Last year, for example, Japanese electronics maker Panasonic became the first international company to pay a ‘pollution premium’ to its expatriate staff in China in an effort to persuade them to stay.

In addition to health issues, bad air quality has also been shown to affects people’s moods, making them more likely to feel unhappy, anxious, depressed and apathetic when air quality is low. Bad moods make people more pessimistic and research has shown that pessimism causes people to reduce the value they place on things.

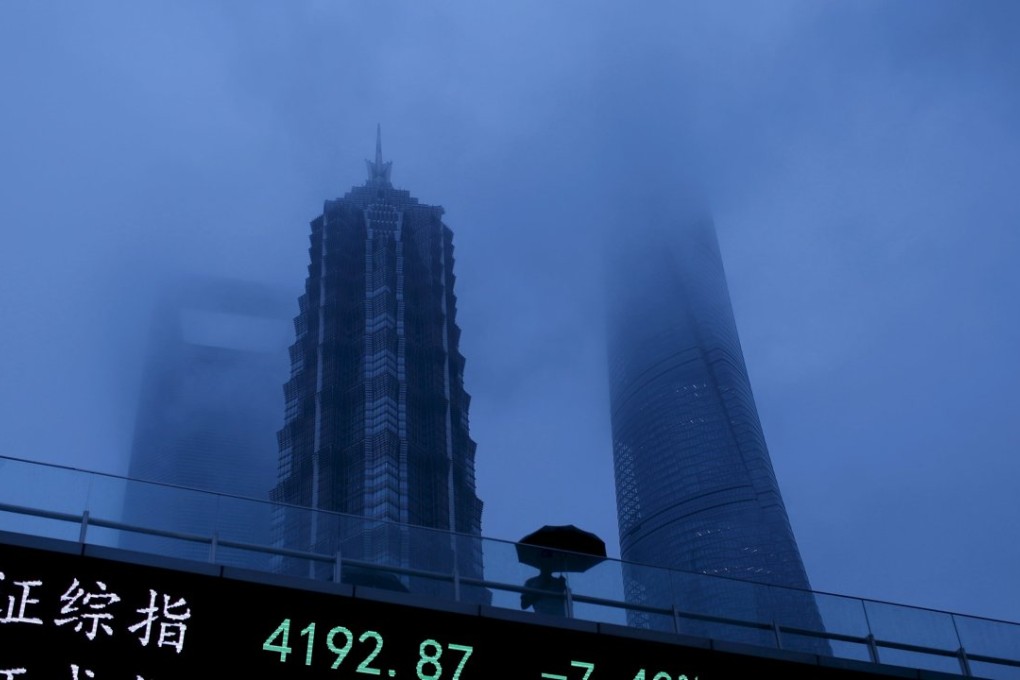

So what impact does pollution have on Chinese investors and, as a result, on stock prices?

Several studies have examined the effect of weather and other environmental factors on trading behaviour. The NYSE’s daily return, for example, has been shown to be associated with weather conditions in New York City - the cloudier the city is, the lower the stock exchange index.