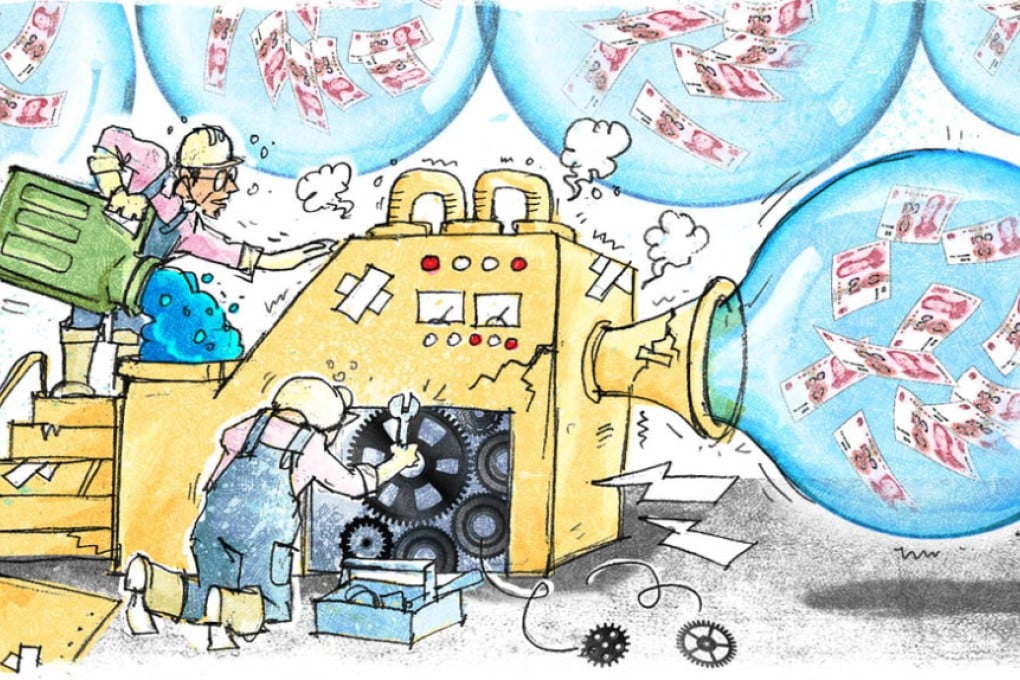

Running out of puff: China can't inflate yet more speculative bubbles to disguise the structural problems in its economy

Andy Xie says China is running out of policy options in its attempt to maintain an impossible position

China's government has just cut interest rates again, demonstrating once more that monetary policy is the country's only meaningful response to the investment bubble bursting. The move comes just weeks after a massive operation to defend the exchange rate. At the same time, the government is propping up the stock market, the credit market, the banking system and all the industries suffering from massive overcapacities. Do the laws of economics apply at all in China?

The "impossible trinity", or trilemma, here says that a country cannot run an independent monetary policy with a fixed exchange rate and free capital flows. Some may argue that China controls its capital account. It is true that the government has shut down underground currency exchange channels, which has lessened some of the pressure on the exchange rate. But corporate foreign debt, cumulative foreign direct investment and offshore renminbi in total are similar to the forex reserves. These monies could all be withdrawn legally. Further, every person can buy US$50,000 of foreign currency from banks per annum. That's six times the per capita income. China's capital account is really open.

China's forex reserves fell by US$329 billion in the first nine months of 2015, while the country ran up a trade surplus of US$424 billion, which would have added to the forex reserves, during the same period. These two numbers roughly summarise the magnitude of capital flight. This is possibly the biggest capital flight in absolute and relative terms that the world has seen in the past three decades.

The government is not dealing with capital flight either technically or fundamentally. When renminbi leaves, the People's Bank of China hands over the dollars and puts renminbi back into the banking system, to stop interest rates from rising. The way to fight capital flight is to raise interest rates. Running down forex reserves doesn't solve any problems.

China is employing two policy instruments that are not available in other countries: first, killing a chicken to scare the monkeys; and second, turning up the propaganda machine to manipulate perception

At the fundamental level, diminishing opportunities for profits is key. China launched a massive investment boom after 2008. It has led to overcapacity virtually everywhere, destroying profit opportunities. The government has manufactured profit opportunities by creating speculative bubbles in the exchange rate, property, credit and stocks, to keep money inside the country.

All these speculative bubbles, perhaps with the exception of the internet bubble, are bursting. The only remaining options are to raise interest rates and undertake a massive devaluation. The former makes it worthwhile keeping money in the country. The latter realises losses upfront, making it too late to run.