China’s economic challenge in 2016: the long and short of it

The country’s leaders will have to walk a tightrope in the new year as they try to juggle short-term targets with long-term goals

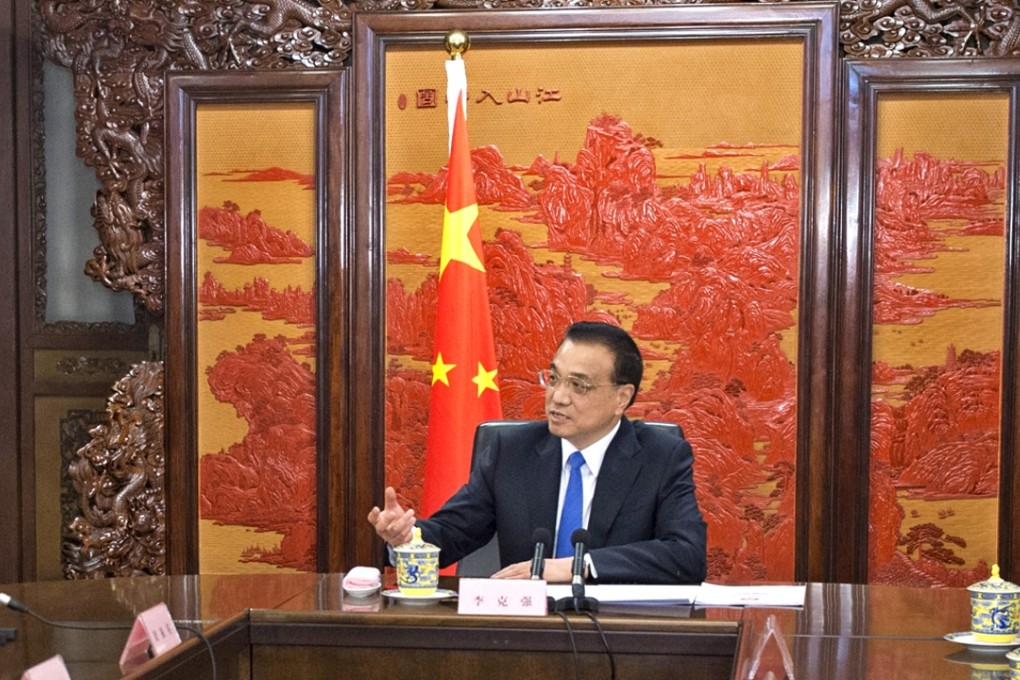

China’s top leaders have leaned towards targeted pro-growth measures in a balancing act between reviving the ailing economy and maintaining long-term sustainability through structural reform. The annual economic work conference in Beijing has set the tone for the country’s economic development next year by endorsing a slew of measures to overcome obstacles to stable short-term growth. The measures, part of a plan endorsed by state leaders, provincial party chiefs and executives of state-owned enterprises, set the stage for next year’s National People’s Congress and Chinese People’s Political Consultative Conference, at which Premier Li Keqiang ( 李克強) will spell out detailed measures to ensure stable economic growth.

The measures are a response to both global economic headwinds and internal structural problems, including a shrinking labour force and an economy in transition from dependence on investment and exports to greater domestic consumption. With GDP growth set to fall this year to the lowest level since 1991 before dipping further in 2016, China needs at least 6.5 per cent annual growth over the next five years to meet mid-term development goals.

In terms of stimulating domestic consumption, a call for the government to cut taxes on corporates and social security contributions for consumers are to be welcomed. The headlines, however, were captured by measures to boost the overstocked property markets, gradually relaxing fiscal deficit restraint and cutting excess capacity which drags on productivity.

Meanwhile, policymakers have been encouraged by data that cheered investors, including better-than-expected loan growth numbers and a monthly rise in factory output and fixed asset investment. Quarterly GDP figures above or below 6.5 per cent will weigh heavily on whether policy decisions lean towards the longer-term restructuring goal or short-term growth. This balancing act illustrates the tough challenges ahead in sustaining stable economic development .