The rich history of mistrust behind China’s warning to George Soros

Tom Plate says Beijing’s suspicion of Western financial advice has its roots in the Asian financial crisis

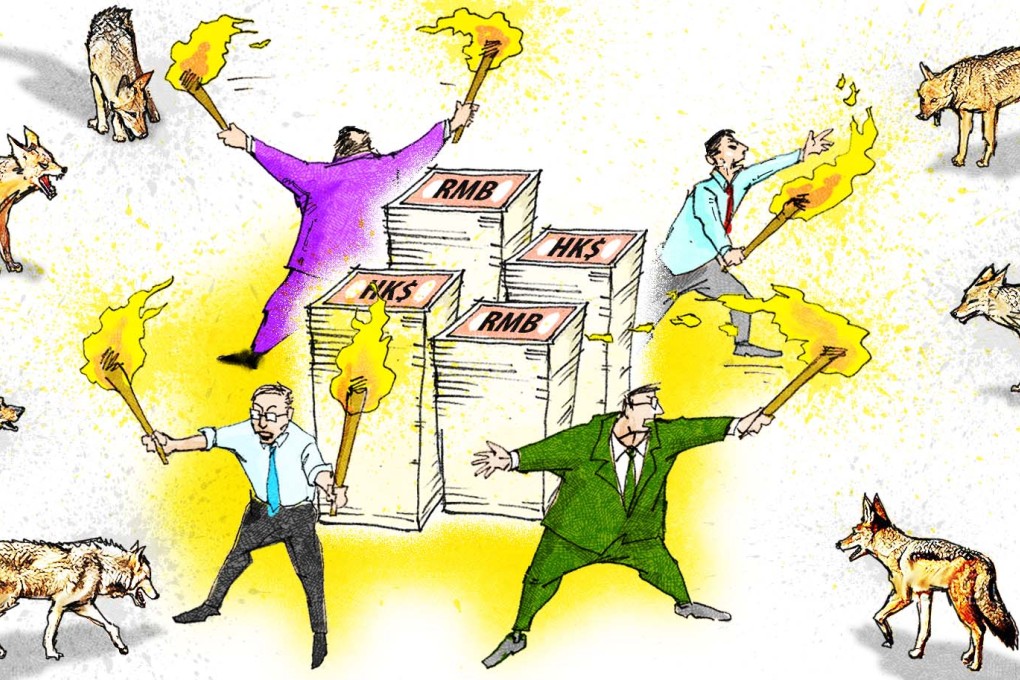

We start our narrative with the Asian financial crisis of the late 1990s. For years, China had been relentlessly advised by US Treasury experts in the Bill Clinton administration, and by other prominent experts in the West, to stop babying its coddled currency and let it go outdoors onto the international markets to play fair and square with other big-time currencies.

In fact, the argument has merit if China is to secure its place in the competitive world marketplace, of which central cosmopolitan idea Zhu Rongji (朱鎔基), the great former premier, was China’s world champion.

In fact, years later, Beijing itself moved in exactly that direction, in part to satisfy the International Monetary Fund that its currency would be cleanly convertible and so globally market-worthy.

But two decades ago, China was not ready for the big bad sandbox, felt both crowded and rushed by the West, and so held back.