For China, communication is key to keeping currency markets calm

Zhang Jun says more openness and transparency by Beijing’s decision-makers could avoid much of the financial turmoil and speculation that has plagued markets of late

That is easier said than done, at least for foreign media, whose struggle to anticipate China’s policy moves has fuelled much frustration – and even accusations that its decision-making is secretive and unpredictable. This struggle is perhaps most apparent today in discussions about China’s exchange rate.

Given that all of this activity is taking place in the offshore renminbi market, the situation remains controllable

But China is not really on the verge of a currency crisis at all. Given that all of this activity is taking place in the offshore renminbi market, which is small in scale and has only limited connections to mainland China’s financial system – the result of China’s hesitancy about financial-market liberalisation and capital account convertibility – the situation remains controllable. Add to that China’s other strengths – annual GDP of over US$10 trillion, a growth rate at least four percentage points higher than the global average, US$3 trillion in foreign-exchange reserves, a savings rate of 40 per cent of GDP, and a massive trade surplus – and an exchange-rate crisis seems highly unlikely.

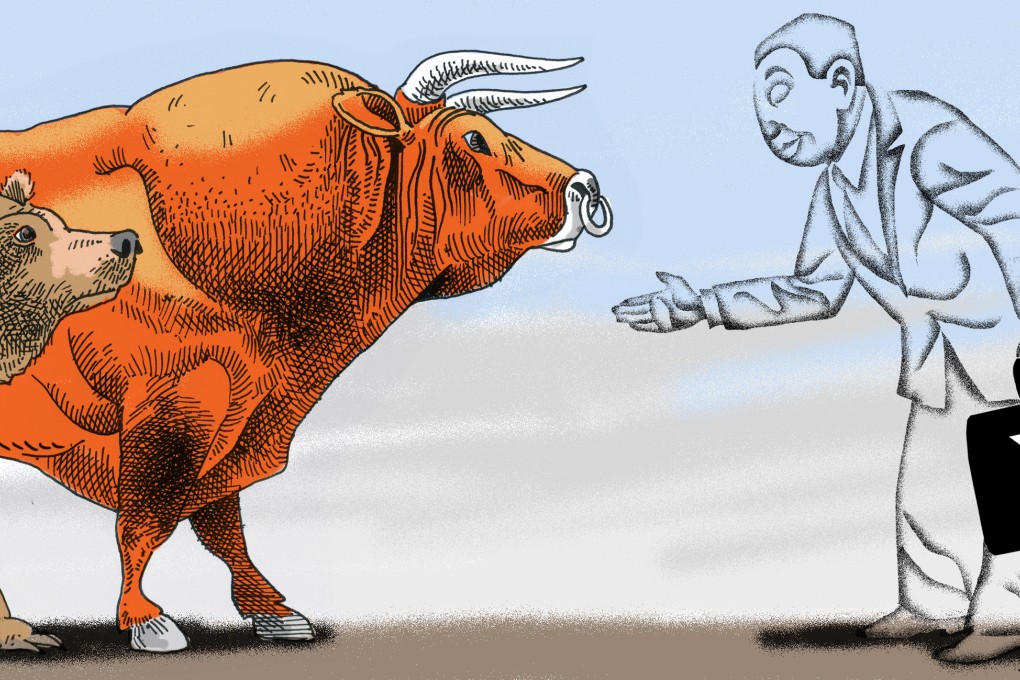

But that does not mean there are no risks. On the contrary, China has a strong interest in curbing the volatility – and, given its centrality to the global economy, so does the rest of the world. The key will be to get markets and policymakers on the same page.

Chinese policymakers have shown a clear commitment to minimising government intervention

Moreover, Chinese policymakers have shown a clear commitment to minimising government intervention and promoting a market-oriented approach for setting interest and exchange rates. And the authorities – particularly those at the PBOC – have made significant progress toward this end.