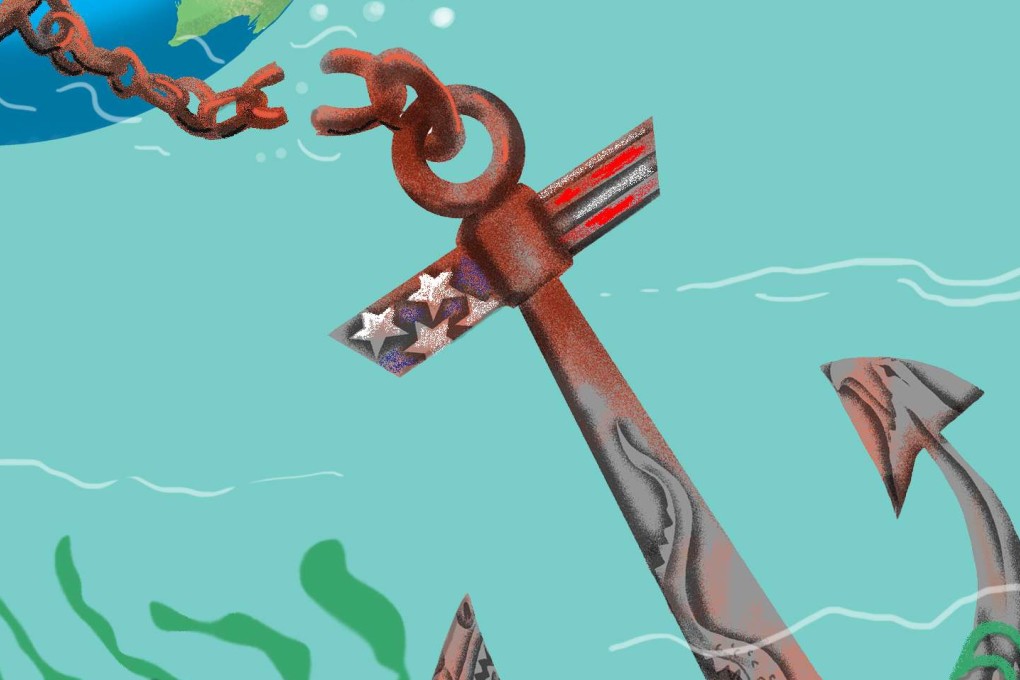

With Sino-US relations fraying, the world is losing its anchor for stability

Andy Xie says important foreign policy decisions may be increasingly dictated by knee-jerk responses, given that both countries are bogged down by domestic problems

The 2008 financial crisis was a turning point. It blew up the fiction that globalisation was good for everyone. American workers defended their living standards with debt, partly backed by inflated property values, as their income came under pressure from global competition. The crisis blew that away. Living standards fell amid declining wages. Globalisation has since become a dirty word in American politics.

Decades after the US embraced free trade, it’s clear who the losers are

Corporate America had a great ride in China. The big consumer companies saw their sales rivalling those at home and achieving bigger profit margins. American companies came to dominate the markets for fast food, personal hygiene, soft drinks, smartphones and the like. China became a magic word in the US stock market.

Lately, China’s economic slowdown and overcapacity are making the market less and less profitable. Chinese copycats are having an impact on profitability in the market and could make it completely unprofitable in a few years. The long-standing demands by corporate America for accessing China’s media and financial markets are falling on unsympathetic ears. In the past, corporate America stepped up to stabilise the relationship whenever a crisis happened. It is less and less inclined to do so.

Is China defending its interests in the South China Sea – or its pride?

On top of a weakening economic foundation comes the new element of strategic rivalry. China has been taking steps to flesh out its claims in the South China Sea. Despite its broad claims, the competing claimants have been extracting up to half a million barrels of oil in the contested waters with nothing for China. China feels aggrieved.