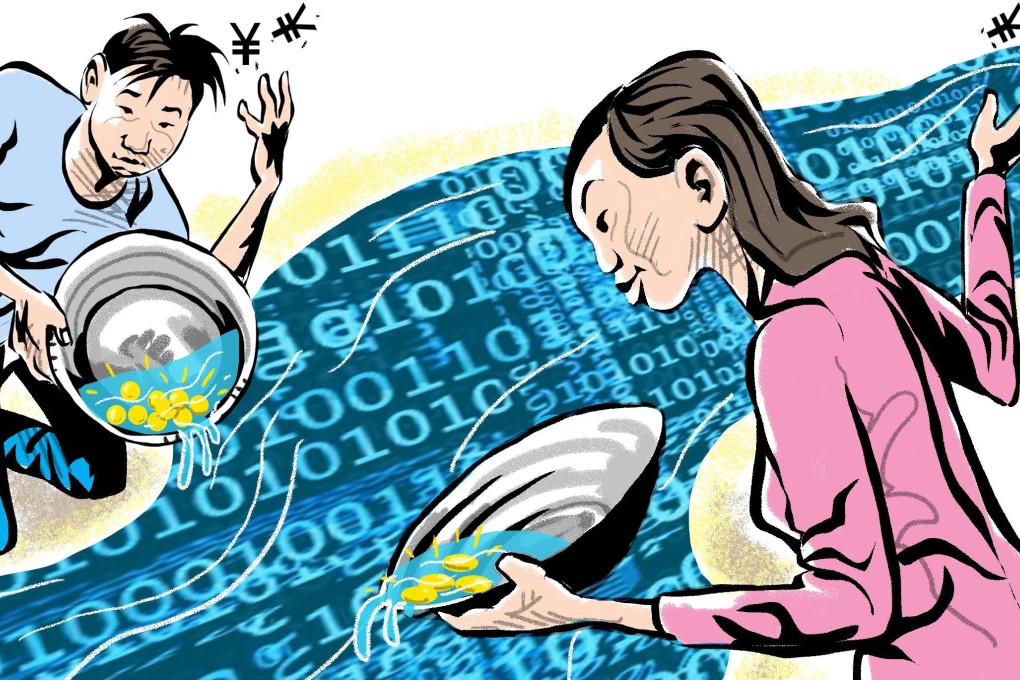

How a fear of inflation is driving bitcoin’s popularity in China

Joe Zhang says despite Beijing’s caution over the digital currency, Chinese see it as a hedge against the erosion of the yuan’s purchasing power

It tells us that a large number of bitcoin mining farms in Inner Mongolia and other remote parts of China are taking full advantage of the cheap electricity and computer hardware to generate massive numbers of bitcoins. In the meantime, it is often said that over half of global bitcoin trading now takes place in China. While the Chinese government is generally cautious about bitcoin, several very active exchanges have sprung up in mainland China, and there is a large army of Chinese participants in the bitcoin food chain.

Why the bitcoin has become China’s new darling

This is odd in light of two well-known facts. First, China is overbanked, and there are bank outlets even in remote corners of the country. The postal savings network and state-backed rural credit cooperatives provide unrivalled banking access for the poor, as well as the rich. Opening a bank account is quite simple; anyone can do so anywhere in the country, usually in less than 10 minutes. It’s even possible to get a debit card the moment the account is opened, with no questions asked. The same applies for a business entity.

Second, Chinese banks and post offices provide very good services for money transfers. In addition, Alibaba, Tencent, Unipay and a host of other payments operators provide transfer services cheaply and even subsidise users. So it’s hard to imagine bitcoins enabling cheaper and more efficient money transfers.

Blockchain technology can help banks beat money-laundering, Hong Kong regulator says

Popper and many others argue that the high volatility of bitcoin’s price prevents it from becoming a currency. I beg to differ.