Reforming China’s stock market still has some way to go, and it is a difficult journey

Unless Beijing is ready to loosen control, market forces cannot be harnessed to make the market function the way it should

Reforming China’s equity market is bit like trying to square a circle. A year after the great stock crash of 2015, policymakers are still being criticised for failing to learn its lessons. The truth is that it is not so much that they have failed in learning, as that they have been given a set of contradictory goals.

The central government wants to let greater market forces into the stock market, yet does not hesitate to intervene as soon as the market goes in a direction contrary to state policy goals. In effect, this means trying vainly to suppress market volatility. Paradoxically, attempts at smoothing out adverse market reactions often make them even more volatile, thereby further damaging the credibility of the central government.

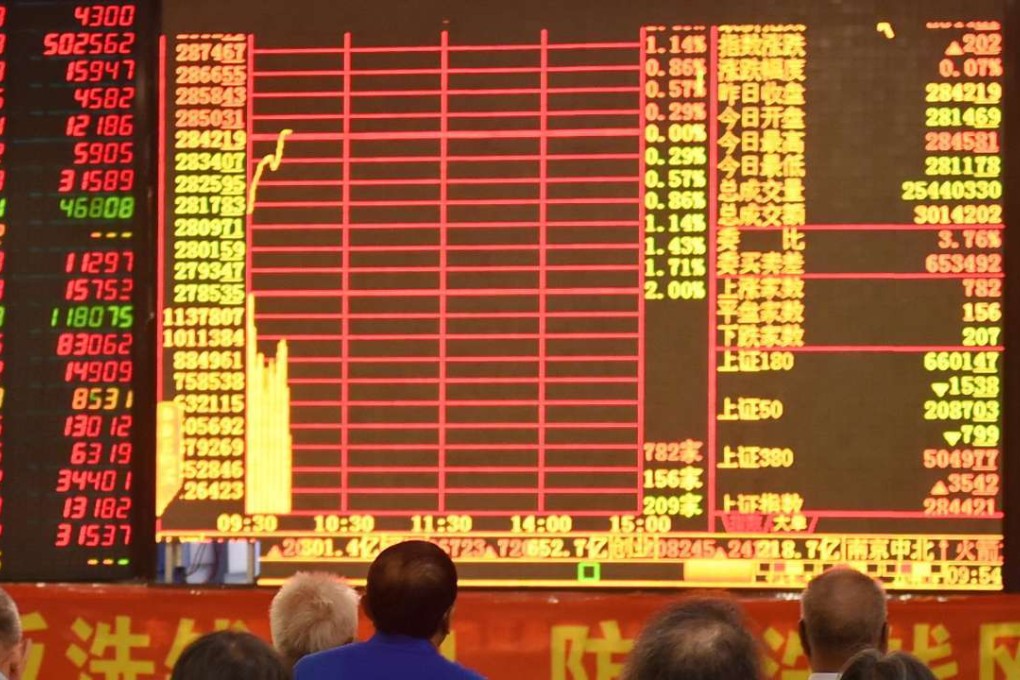

This was exactly what happened about a year ago. As the market rout continued through the summer, the nation’s biggest brokers were summoned by regulators to help turn around a crash that had wiped off a third of the market’s value in three weeks. But instead of restoring confidence, the market continued to slide. Even today, the Shanghai stock market is still 20 per cent below where it was early last summer. The nation’s leaders have tried to put on a brave face. In March, Premier Li Keqiang (李克強) said Beijing’s measures for the stock market had achieved the desired effect of preventing systemic risks.

To an extent, that is true, but only because the Chinese stock market has never been an accurate gauge of the underlying economy, and its volatility rarely spills over into the much larger economically productive sectors. That may be good in the short term as the economy is already slowing without having to suffer more serious shocks. But it has become a big problem as Beijing aims to achieve a more balanced economy. Even today, corporate borrowing is still mainly driven by debt-financing through lending by the big state-run banks. Major equity financing through the stock market can be a major step forward in having an alternative source of funding. Moreover it also promotes greater efficiency in allocating funding to worthy commercial entities beyond those with close ties to the big banks.

Unfortunately, China’s stock market reform is still a work in progress, and last year’s turmoil has only made it harder for regulators to achieve it. The nation’s economic policymakers such as Zhou Xiaochuan (周小川) actually have an excellent understanding of the problems they face in market reforms. But unless Beijing is ready to loosen control, market forces cannot be harnessed to make the stock market function the way it should.