It’s all or nothing for China as trade collision with the US looms

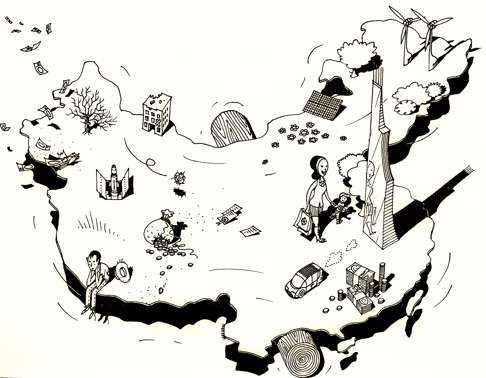

Andy Xie says rising US interest rates and China’s property bubble at bursting point, coupled with renminbi depreciation fears, are set to whip up the perfect storm. But China could make the decision to change, and make 2017 a year of breakthrough

The best-case scenario would be that China holds up the currency, accepts the bursting of the property bubble, and embarks on fundamental restructuring to ultimately lead the global economy.

The worst-case scenario would see a maxi-devaluation of the renminbi, coupled with a China-US trade war that could spiral into military conflict.

Watch: How the Fed rate hike impacts Asian markets

This time may not be different. The higher US interest rate and infrastructure stimulus would suck liquidity out of emerging economies. This is happening at a most inconvenient moment for China. Its property bubble is already at bursting point, while expectations of currency depreciation are already draining liquidity.